“Your dollar will be worth just as much tomorrow as it is today,” President Nixon proclaimed on television with a straight face.

“The effect of this action, in other words, will be to stabilize the dollar.”

The date was August 15, 1971. President Nixon just announced that he was closing what was known as the “gold window”. This was the system through which foreign countries could redeem U.S. dollars for physical gold upon demand.

The gold window was a fixture of the Bretton Woods System of 1944. That was the international agreement which established the U.S. dollar as the world’s reserve currency.

What we’re talking about here is trust. The idea was that if the U.S. started printing too much money, the rest of the world could trade their dollars in for gold.

Makes sense, right? Nobody wants to hold a currency that can be created from nothing at will.

President Nixon got rid of this restraint on money-printing in 1971. The story behind that move is very nuanced. But what followed isn’t…

According to the Federal Reserve’s data, the U.S. has created trillions of dollars from nothing since then.

Naturally, this reduced the purchasing power of each dollar in circulation. That’s just basic supply and demand economics.

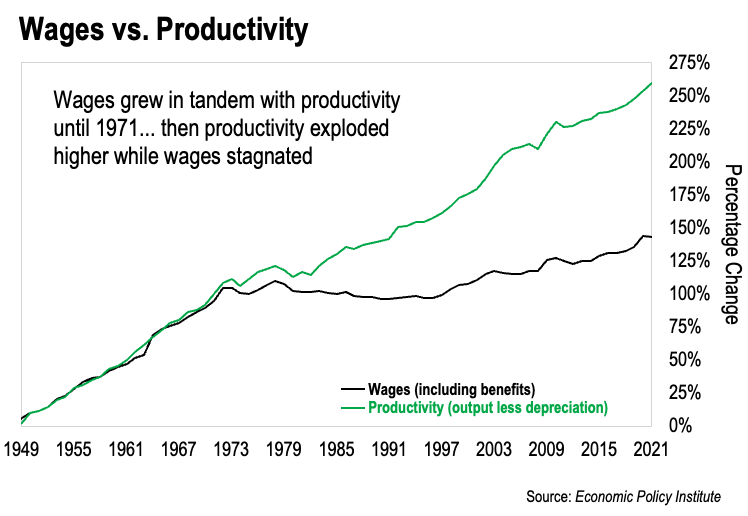

We see this very clearly in the form of rising consumer prices. But there’s a hidden story at work here also. This chart spills the beans:

This data comes from a study done by the Economic Policy Institute. They measured the growth in median U.S. wages, adjusted for inflation, against total productivity – the output of goods and services. This data goes back to the late 1940s.

And we can see very clearly that wages moved in lockstep with overall productivity up until 1971. That means the average guy’s salary went up in proportion to America’s output of goods and services. As it should be.

We can also see very clearly that our productivity has continued to explode higher to this day. But our wages, adjusted for inflation, have been mostly flat since 1971.

The reason?

Those trillions of dollars created from nothing steal purchasing power from everybody. And this happens year after year. That’s why it’s so hard to get ahead these days.

And this is why we need to rethink financial planning 101. We talked about that yesterday.

Fortunately, there is a solution.

There is one tried-and-true investment that puts inflation to work for us, rather than against us. What’s more, this investment also creates passive income streams for us.

Passive income is critical. It’s how we fill in the gaps caused by stagnating wages. And with the right system, our passive income can quickly grow to meet and exceed our annual salary.

That’s what our new Rental Real Estate Accelerator program is all about. It makes building passive income with real estate simple.

With our system, anybody can work up to $2,000 or $3,000 a month in passive income in just a few years. No previous knowledge or experience necessary.

From there, getting to $10,000 a month or more is just a matter of accelerating the process.

And here’s the thing – this can be done with no more thirty minutes worth of work each month. That’s the beauty of having the process and the networks already in place.

So we’re not talking about a side hustle here. We aren’t talking about an online business where we have to work nights and weekends to get the extra income.

Our approach to rental real estate is far more simple.

If you’re ready to get serious about building passive income, please give our program a look. You can find more information right here:

Rental Real Estate Accelerator Program

By the way, we’re running a 30% off special this week. Just use the coupon code “RREA” at the checkout page to take advantage of it.