“Your dollar will be worth just as much tomorrow as it is today,” President Nixon proclaimed on television with a straight face.

“The effect of this action, in other words, will be to stabilize the dollar.”

The date was August 15, 1971. President Nixon just announced that he was closing what was known as the “gold window”. This was the system through which foreign countries could redeem US dollars for physical gold upon demand.

The gold window was a fixture of the Bretton Woods System of 1944. That was the international agreement which established the US dollar as the world’s reserve currency.

What we’re talking about here is trust. The idea was that if the United States started printing too much money, the rest of the world could trade their dollars in for gold.

After all, nobody wants to hold a currency that somebody else can create from nothing anytime they want.

The story behind Nixon’s “gold shock” is very nuanced. But what followed isn’t…

According to the Federal Reserve’s data, the US created over $8 trillion dollars from nothing since Nixon closed the gold window in 1971.

Naturally, this reduced the purchasing power of each dollar in circulation. That’s just basic supply and demand economics.

We see this very clearly in the form of rising consumer prices. But there’s a hidden story at work here also. This chart spills the beans:

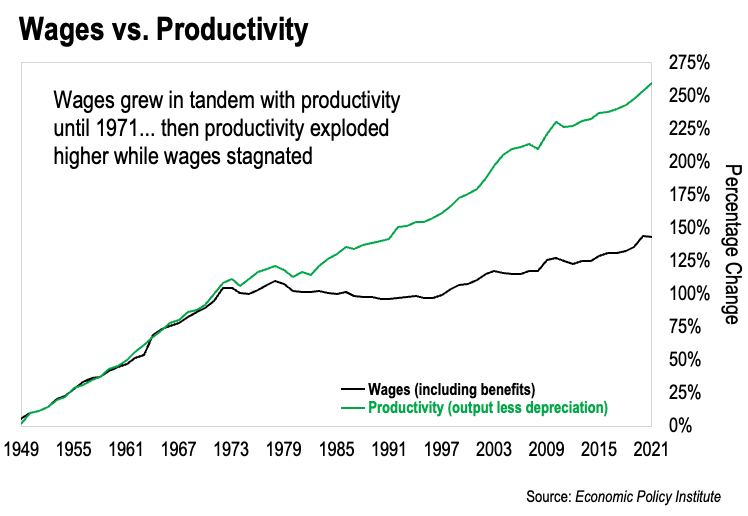

This data comes from a study done by the Economic Policy Institute. Researchers there measured the growth in median US wages, adjusted for inflation, against total productivity – the output of goods and services. This data goes back to the late 1940s.

And we can see very clearly that wages moved in lockstep with overall productivity up until 1971. That means the average guy’s salary went up in proportion to America’s output of goods and services. As it should be.

We can also see very clearly that our productivity has continued to explode higher. But our wages, adjusted for inflation, have been mostly flat since 1971.

The reason?

Those trillions of dollars created from nothing stole purchasing power from everybody in the economy. And where does that purchasing power go?

To the people who get to use the newly created money first.

Ever wonder how the US government can spend trillions of dollars on every kind of program imaginable… and still run trillion-dollar deficits?

This chart explains it.

The act of creating new dollars from thin air effectively transfers all American productivity gains to Washington, DC. That’s been happening since the early 70s.

This dynamic is why it’s so hard to get ahead these days. And it is why we need to rethink financial planning 101.

Fortunately, there is a solution.

There is one tried-and-true investment that puts inflation to work for us, rather than against us. What’s more, this investment also creates passive income streams for us.

Passive income is critical. It’s how we fill in the gaps caused by stagnating wages. And with the right system, our passive income can quickly grow to meet and exceed our annual salary.

That’s what we focus on in The Phoenician League.

We have a step-by-step approach to bulletproofing our money and building extra monthly income. That’s how we mitigate inflation and keep up with rising costs of living.

With our system, anybody can work up to having $2,000 or $3,000 a month in passive income in just a few years. No previous knowledge or experience necessary.

From there, getting to $10,000 a month or more in extra income is just a matter of accelerating the process.

And here’s the thing – this can be done with no more thirty minutes worth of work each week. That’s the beauty of having the process and the networks already in place.

So we’re not talking about a side hustle here. We aren’t talking about an online business where we have to work nights and weekends to get the extra income.

Our approach is far more turn-key.

Look, it’s getting tough out there. The rules of money have changed.

But that doesn’t mean we need to fall victim to the circumstances. Quite the opposite.

I’m reminded of an old saying I heard years ago. It goes: Either you happen to the world or the world happens to you.

Let’s be the kind of people that happen to the world. That’s what The Phoenician League is all about.

If you’re interested in learning more about our membership, our doors are currently open. You can find more information right here:

Achieve Financial Independence Using an Ancient Investing Secret

-Joe Withrow