The snow continued to fall throughout the night up here in the Virginia highlands. It was a fine, sticky snow that clings to everything, creating a winter wonderland.

Here’s a shot from this morning:

And speaking of frozen…

Between March and May of last year, the United States saw the 2nd and 3rd largest bank failures in its history.

At the time I was in touch with a tech entrepreneur who had recently launched a new company. She had $2 million parked at Silicon Valley Bank (SVB) – one of the banks that collapsed. Those funds were her company’s start-up capital.

The bank’s management told her on a Friday that they would let her know by Monday how much of her money she could withdraw – if any. She was left to spend the weekend wondering if her company was about to be bankrupt.

It turns out that JP Morgan was allowed to buy SVB’s assets for pennies on the dollar, and my tech entrepreneur’s company was saved. But this highlights something critically important in the world of finance… confidence.

The financial news made it sound like SVB magically collapsed without warning. But that’s not the case.

SVB simply got caught with what’s called a duration mismatch in the banking world. The bank had a large portion of its reserves in long-term U.S. Treasury bonds and mortgage-backed securities.

Now, the market value of a bond moves inverse to interest rates. When rates go up, bond values go down.

And that’s what triggered an old-fashioned bank run at SVB. The value of its bond portfolio declined dramatically… which raised questions about its financial health.

What’s interesting though is that SVB planned to hold those bonds to maturity. And when a bond matures, investors get their original investment back. No matter what.

So the fact that SVB’s bond portfolio declined in value shouldn’t have been such a big deal. It was largely just a paper loss.

But SVB’s customers caught wind of the large paper loss and they scrambled to withdraw their money from the bank. That is to say, they lost confidence.

That’s the problem with confidence. It can blow away like leaves in a gale.

And this same dynamic applies to the US dollar as it pertains to the global financial system…

The US dollar has been the world’s reserve currency since 1933. But the BRICS alliance seeks to change that.

BRICS refers to an economic alliance originally forged between Brazil, Russia, India, China, and South Africa. Several other countries have since joined the bloc.

The BRICS countries now represent 42% of the world’s population and 36% of global gross domestic product (GDP).

And this trading bloc is working furiously to build an alternative payment system so they can ditch the US dollar.

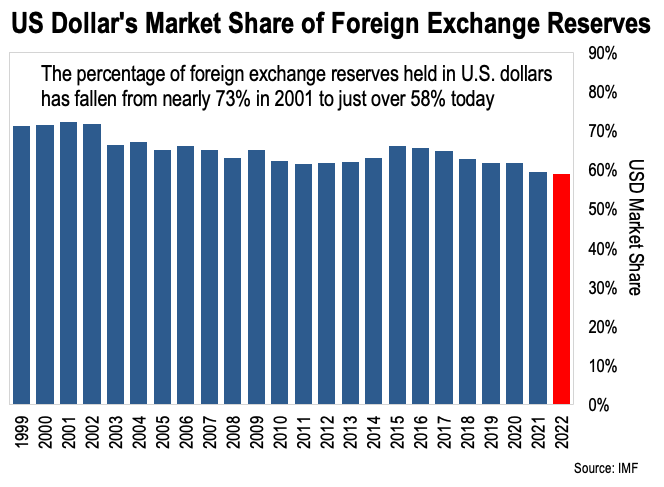

Slowly but surely, the dollar is losing market share.

This shows us that global demand for US dollars and dollar-denominated assets has fallen.

You don’t need a degree in international relations… or a deep understanding of geopolitics to know why this is a big threat to asset prices in the US.

As more nations figure out how to avoid it, demand for US dollars will continue to decline. And that means fewer foreign countries and corporations will be investing in US stocks and bonds.

This is the second factor creating what I call, “the new rules of money.”

The old rules – where the Fed would bail out everyone every time something went wrong… well, those days are behind us. Because the Fed can’t afford to bail anyone out going forward.

It’s going to be too busy trying to defend the dollar and delay the inevitable for as long as possible….

So the financial landscape is changing… and it’s changing fast. We would be wise to change our approach to money and retirement planning accordingly.

More to come on that front tomorrow…

-Joe Withrow