“Your dollar is a promise, a pact of trust,” President Nixon once assured the nation. “It will hold its value, come what may.”

The date was August 15, 1971. The day the world’s financial landscape was forever altered.

Nixon had just closed the “gold window”, a system that allowed foreign countries to exchange their US dollars for physical gold. This had been a cornerstone of the global monetary system for nearly 30 years.

The essence of this system was trust. But not in the US dollar. In gold.

If the United States started to print money excessively, the rest of the world could exchange their dollars for gold. That’s what the gold window was for.

The narrative behind Nixon’s “gold shock” is complex, but the aftermath is starkly clear…

Since Nixon’s decision, the US has created over $8 trillion out of thin air. This naturally diluted the purchasing power of each circulating dollar.

This is evident in the rising consumer prices we are all grappling with today.

But there’s another, less visible story unfolding. This chart reveals the truth:

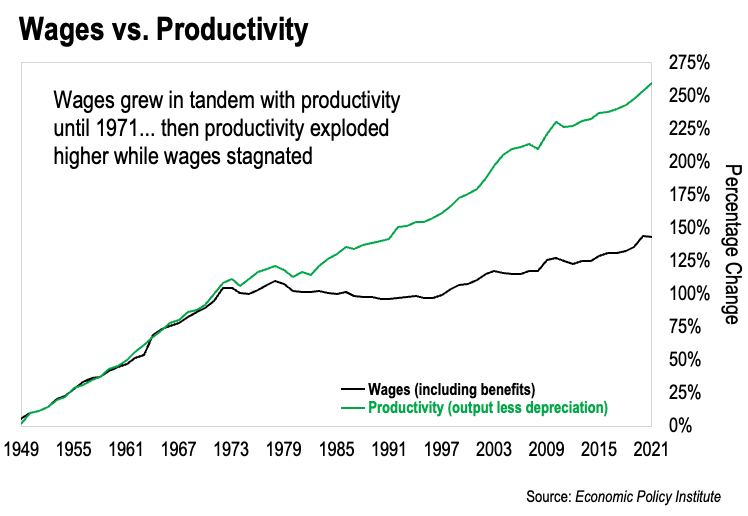

The chart compares the growth in median US wages, adjusted for inflation, against total American productivity. The data spans from the late 1940s to the present day.

It’s clear that wages and productivity were in sync until 1971. The average person’s salary increased proportionally with America’s output of goods and services. Just as it should.

But look at what’s happened since. Our productivity powered forward… but our inflation-adjusted wages went stagnant.

Why?

The trillions of dollars created from nothing siphoned purchasing power from everyone in the economy. And remember, this data is measuring the real purchasing power of wages adjusted for inflation.

In other words, nominal wages have gone up. In dollar terms, the median salary is higher than it’s ever been.

The problem is, those dollars buy just a fraction of what they once did. Because their purchasing power was stolen.

And where does this stolen purchasing power end up?

In the hands of those who get to use the newly created money first.

Creating new dollars out of thin air effectively funnels most of America’s productivity gains to Washington, DC and Wall Street. We can see that clearly in the chart above.

This dynamic is why it’s become more and more difficult to get ahead. If we follow the traditional success path, that is.

My friends, it’s time to shift our focus to a new approach—one designed for the times we find ourselves in today. If we do, true financial security is more available to us than ever before.

Stay tuned for a major announcement on that next week.