Last week we looked at the strange de-banking trend and the history of our money.

In our brief history lesson, we noted how the dollar was not only backed by precious metals for most of its history – it was in fact defined as a specific amount of silver and later gold.

But everything changed in 1971. That’s when President Nixon cut the dollar’s last link to gold.

This thrust the world on a purely fiat monetary system controlled entirely by governments and central banks. Fiat is the Latin word for “let it be done”.

This is what gave rise to the Age of Paper Wealth I highlighted in my book Beyond the Nest Egg. Because the fiat system removed all restrictions on printing money.

It took most governments about a decade to realize this. But once they did, they didn’t look back…

From 1982 to 2022, most nations printed their currency excessively to finance all kinds of government programs. As part of this, central banks used newly created money to buy sovereign (government) bonds… which dropped interest rates to zero around the world.

This fueled a massive stock market boom that lasted for four decades. That’s what gave rise to the idea that stocks only go up over time. Much of our mainstream personal finance advice is based on this premise.

The reality is, what happened from 1982 to 2022 was not normal. Instead, it destroyed our monetary system and the value of our dollar.

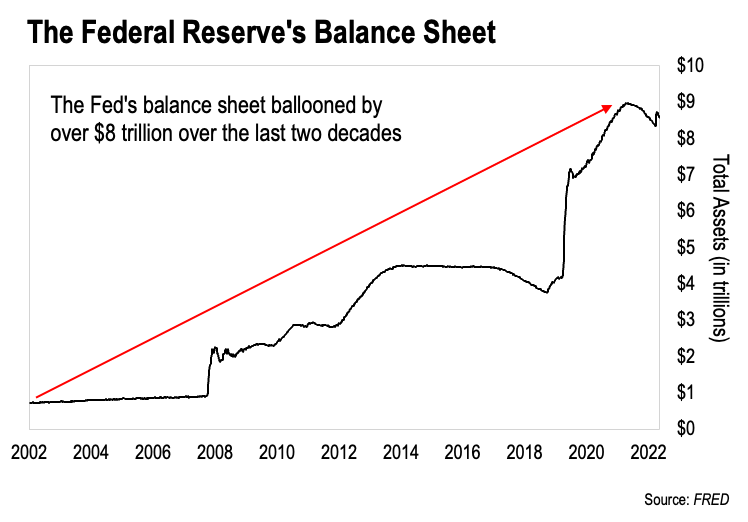

The Fed and the US Treasury worked hand-in-hand to create over $8 trillion dollars from thin air over this time period. We can verify that $8 trillion because it hit their balance sheet.

Here’s the chart:

This is a chart of the assets held on the Federal Reserve’s balance sheet going back to 2002. When we see that black line going up, that’s the Fed buying assets. These are mostly US Treasury bonds and to a lesser extent mortgage-backed securities.

As we can see, the Fed owned less than $1 trillion worth of assets in 2002. But over the next 20 years it bought over $8 trillion worth of bonds.

And where did the Fed get the money it needed to buy these assets?

As we noted, it created those dollars from nothing. Then that liquidity worked its way into the financial system, driving the US stock market higher and higher.

This enriched two sets of people – those in Washington, DC who got to use the newly created money first for all manner of government programs. And those on Wall Street who benefitted the most from the massive bull market in US equities.

But this also had a subtle, devastating impact on American society. We’ll examine that tomorrow.

-Joe Withrow

P.S. In other news, we just launched our official author page to keep you updated on all our latest projects and insights. And to celebrate, we’re offering exclusive access to two in-depth special reports on money and investing for those interested.

You can claim your reports at https://joewithrow.com/. Just scroll down to the bottom of the page for more details.