The world changed forever in 2022.

I think most of us know this to be true. We can feel it. But this next chart tells the story quite well:

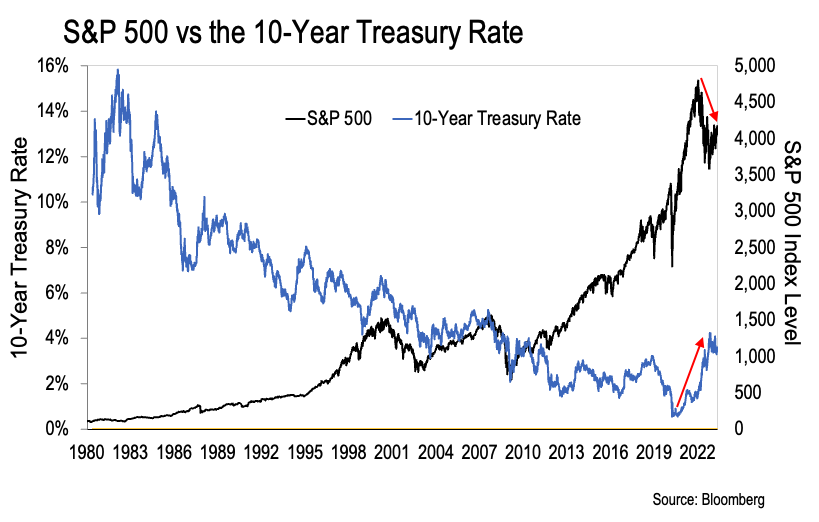

Here we can see the S&P 500 and the 10-Year Treasury rate going back to 1980. The S&P 500 is the black line. And the 10-Year Treasury rate is the blue line.

We’re using the S&P 500 as a proxy for U.S. stock prices. And we’re using the 10-Year Treasury as a proxy for interest rates. And this chart makes it perfectly clear that the two are inversely correlated.

Interest rates started falling in 1982… and they fell consistently for the next forty years. Meanwhile, U.S. stocks consistently went up in value over that same time period.

But everything reversed in 2022. Rates started going up… and stock prices started to fall. We can see those moves clearly marked by the red arrows on the chart above.

When we zoom out like this, it’s no surprise that stocks fell hard when rates started to rise in 2022. But it sure caught a lot of people by surprise.

In fact, many financial analysts spent over twelve months trying to convince themselves and their clients that these moves were temporary. Just wait for the Fed to pivot, they said. Then we’ll get back to normal.

But here’s the thing – what happened from 1982 to 2022 was not normal. Nor was it organic.

Instead, it was all driven by the debasement of our money. The U.S. government and the Federal Reserve (the Fed) worked hand-in-hand to create over $8 trillion dollars from thin air during this time period.

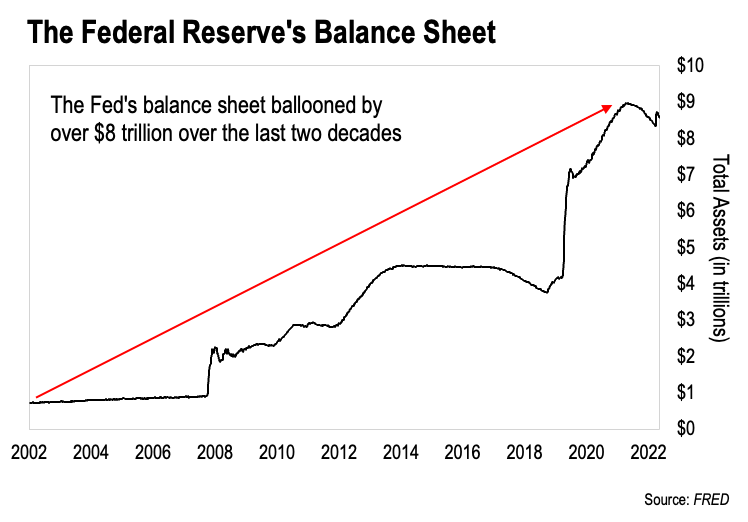

We can see this very clearly simply by looking at what happened to the Fed’s balance sheet:

Here we can see that the Fed’s balance sheet grew by over $8 trillion from 2002 to 2022.

The key here is that when we see this line going up, that’s the Fed creating new dollars from thin air. The Fed used those new dollars to buy financial assets – U.S. Treasury bonds and mortgage-backed securities. That’s why its balance sheet ballooned.

These new dollars are what drove interest rates down to nearly zero. They are also what bid U.S. stock prices up tremendously.

Essentially the funny money decoupled interest rates and stock prices from the underlying economy.

In other words, these trillions of dollars created from nothing “financialized” everything. They turned the stock market into a giant casino. Except the game was rigged such that stock prices only went up over time.

Thus, this time period – 1982 to 2022 – will go down in history as The Age of Paper Wealth. It was a time when people truly believed that printing money could create wealth.

Of course, it was all an illusion. That’s easy to see when we look at it objectively.

The problem is, nobody under the age of 60 has known anything else in their adult life. All they’ve known is falling interest rates and rising stock prices.

And our approach to personal finance reflects this. Everybody has been encouraged to plan for retirement by pouring their savings into financial assets – stocks and various kinds of funds.

That approach made some sense in a world where rates only go down and stocks only go up. But if we’ve left that world – if the Age of Paper Wealth has ended – does it still make sense to manage our finances this way?

I don’t think so.

To me it’s very clear that we need to rethink personal finance 101. And that’s exactly what our flagship course Finance for Freedom is all about.

How do we build financial security in this new world we’ve entered into? Finance for Freedom answers that question. More information right here: