After 20 years in finance, I’ve learned that so much of it has to do with your perspective and your attitude. There’s an old saying that sums it up nicely: “If you know what’s happening, you’ll know what to do”.

Of course, the challenge is to know what’s happening.

We’ll come back to that in just a minute. But first I’d like to share a photo with you:

I snapped this one from behind my home office this morning. I never tire of seeing the majestic barefaced cliffs in the background covered in snow.

Getting back to finance…

One of the primary themes I’ve been tracking in these pages is a major paradigm shift in the financial markets.

From 1982 to 2022, interest rates went down consistently while US stock prices moved higher. That made financial planning simple. Buy a few funds that track US equities and then sit tight…

But the trend reversed in 2022. Rates rose rapidly while stock prices fell.

This signaled that it was time to rethink financial planning 101 – which prompted me to write a book about it.

For a while my thesis played out perfectly for all to see. But then the “Fed pivot” craze kicked back into gear and US equities went on a tear to end 2023.

According to the financial news, the US stock market just made a new all-time high in December. And in nominal terms, that’s true. So it seems like the Age of Paper Wealth is alive and well, right?

Not so fast my friend….

Remember, a price is just a measurement of value. So when they say stocks hit all-time highs that means they are worth the most they’ve ever been when priced in dollars.

Now let’s look at what’s really going on.

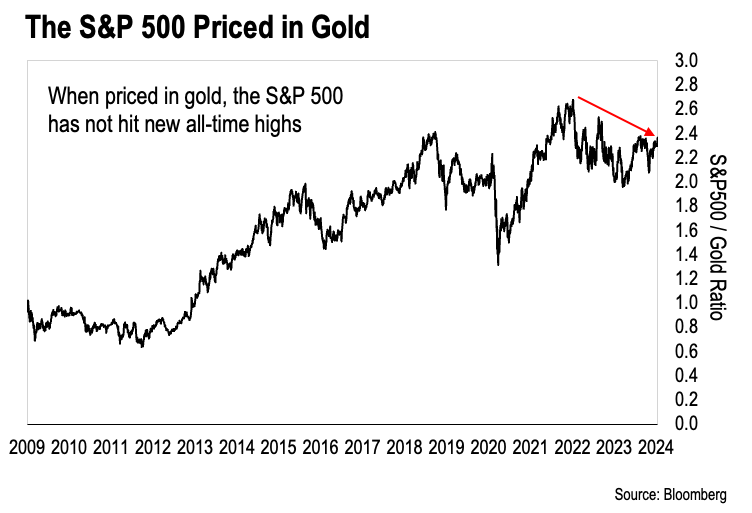

When we measure stocks in terms of something that cannot be inflated like gold, the picture is much different. This chart tells the story:

As we can see, the S&P 500 did not make new all-time highs last month when we price the index in terms of gold. Instead, pricing the S&P 500 in gold reveals a declining trend in the stock market.

So what’s the discrepancy here?

Inflation.

The Federal Reserve (the Fed) created nearly $6 trillion from nothing in 2020 and 2021. And the US Treasury pumped another $814 billion into the economy via its fiscal “stimulus” programs in 2021.

This created a tidal wave of liquidity in a very short period of time… and that liquidity drove up prices for virtually everything.

Measuring stocks in dollar terms is like using an elastic ruler. It’s not accurate because the ruler (the dollar) is being “stretched” by massive supply increases.

The more dollars they print, the more prices rise. This includes stock prices. But that is not the same as saying stocks are worth more.

When you measure them in gold – the most “inelastic” ruler of the last 5,000 years – you see that stocks are actually falling in value.

Technically, your stocks are worth less than they were in 2021 – even though the price (measured in dollars) says they went up.

And that brings me to one of the most important new rules of money:

The way you protect and grow your money as the dollar decreases in value is to own real assets.

You want to own assets that:

- Don’t depend on the Fed’s ability to keep interest rates artificially low (they won’t be able to)…

- Go up if the Fed (or the Treasury) create dollars from nothing…

- And most of all, you want a portion of your asset portfolio to give you an income stream…

More on that tomorrow…

-Joe Withrow