submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

The Only Debate Topic That Matters

September 29, 2016

Hot Springs, VA

“Loading up the nation with debt and leaving it for the following generations to pay is morally irresponsible. Excessive debt is a means by which governments oppress the people and waste their substance. No nation has a right to contract debt for periods longer than the majority contracting it can expect to live. ” – Thomas Jefferson

The S&P closed out Wednesday at $2,171. Gold closed at $1,327 per ounce. Crude Oil closed at $47.12 per barrel, and the 10-year Treasury rate closed at 1.57%. Bitcoin is trading around $605 per BTC today.

Dear Journal,

Nearly one-third of all Americans – almost 100 million people – tuned in to watch the first presidential debate earlier this week. This represents an increase in viewership by nearly 40% from the 2012 presidential debates, and it almost rivaled television’s biggest draw – the Super Bowl – which received 112 million viewers last year. Apparently the debate was aired on television throughout Europe as well.

I see these numbers and the first thing that pops into my head is a question: how in the world do the ratings agencies know how many people are sitting on the couch in front of a given television?

I didn’t spend too much time with this, but all of the numbers I have seen reference “viewers” and “people”, not “households”. They are very specific about this.

I can’t help but think about poor Winston in George Orwell’s 1984 – he sits down in front of his telescreen and while he is watching it, it is also watching him…

In any case, I am happy to report that I am in the two-thirds majority of people who did not tune in for the first presidential debate. I did skim through the highlights, however, and I was not surprised to see that the single most important issue which will impact hundreds of millions of people negatively was not discussed.

That issue is the U.S. government’s accrual of $200 trillion in unfunded liabilities.

This number is not carried anywhere on the books, but it is very real. In short, these are future financial commitments that have been made to citizens for which there is no revenue support and no real asset backing. The bulk of these unfunded liabilities are related to Social Security and Medicare, but this will have a widespread impact that spreads well beyond those two programs.

Demographics show that 10,000 people in the United States are turning 65 every single day for the next ten years. All of those people have been taxed their entire working lives to fund Social Security and Medicare with the expectation that they will be made whole upon reaching retirement age themselves.

But both of these programs already run deficits to the tune of tens of billions of dollars every year, and that deficit is only going to grow as all of the people reaching retirement age sign up for Social Security and Medicare. Project this dynamic out, along with numerous other insolvent programs, and that’s where the $200 trillion in unfunded liabilities comes from.

How can the U.S. government finance any of the expenditures that the presidential candidates called for on Monday night when it is already on the hook for $200 trillion to the very people who’s productive efforts have supported it for the past 40 or 50 years?

Do you think Uncle Sam will tell the nice elderly couple next door that he has to cut back on their Social Security payments? Do you think he will tell them that he cannot cover their medical expenses anymore?

I doubt it.

Instead, I suspect Uncle Sam will do what he has always done when he came up a little short. He will create some Treasury Bonds and try to sell them to foreign central banks with the promise to tax everyone in his sight perpetually to service the debt. Then when foreign central banks only buy a very small fraction of the bonds he needs to sell, Uncle Sam will call up his friends at the Federal Reserve and ask them to buy the rest. The folks at the Fed will then create a few journal entries on their computer and – voila! – they now have the dollars necessary to buy the bonds. So Uncle Sam sends the bonds over to the primary dealer who delivers them to the Fed. The Fed delivers the money to the primary dealer which keeps a cut for itself and then delivers the rest to Uncle Sam.

So the Feds get their bonds, Uncle Sam gets his money, the Bank gets its cut, and the nice couple next door get their Social Security check. Everybody is happy!

But there is a limit to this magic money machine… the devil is in the details.

This is a bit of a simplification, but as the new dollars work their way into the general economy, they necessarily reduce the value of all dollars in existence. We see this in the form of rising prices on goods and services. This effect is not instantaneous nor is it equally distributed, and there are other factors at play, but over time the act of inflating the money supply raises costs of living across the board. So the elderly couple next door still get their Social Security check every month, but their dollars don’t stretch as far when they go to the grocery store.

Further, because Treasury Bonds are a debt instrument, Uncle Sam is now deeper in debt; debt that he must pay interest on. This means Uncle Sam needs even more money to consistently meet his obligations.

So the act of creating new money also created new debt which created a future need for even more money… uh oh!

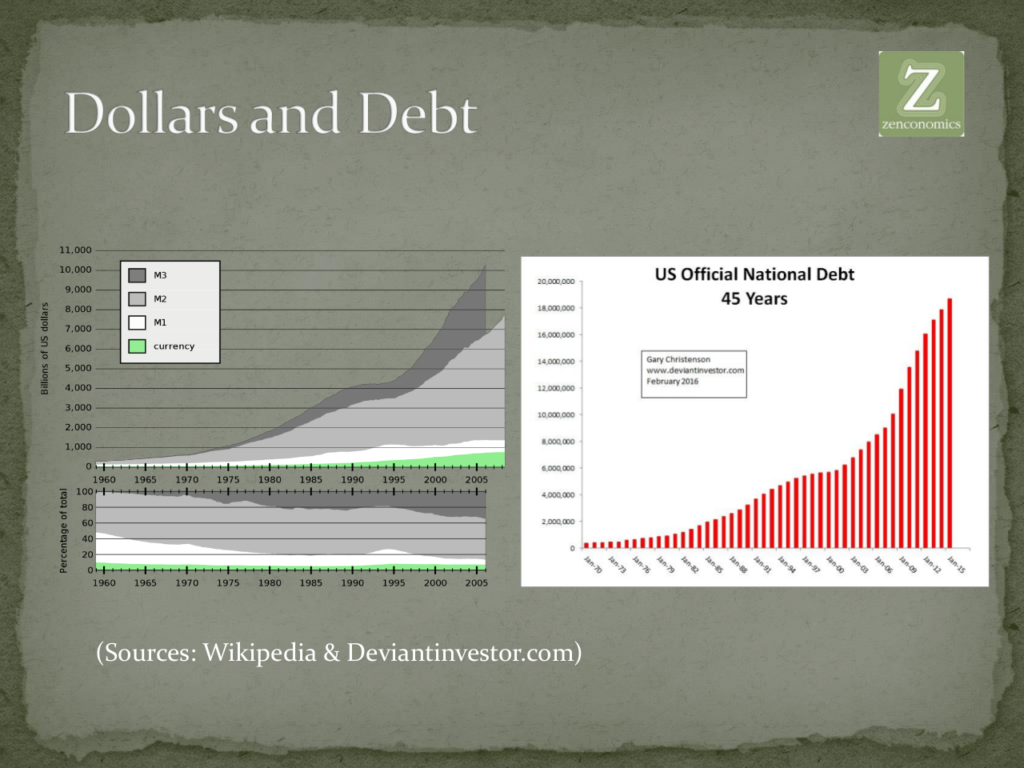

Take a look at these two charts comparing the expansion of the money supply on the left to the growth of U.S. national debt on the right. You can see the two go hand-in-hand.

As the debt grows, the declining marginal utility of credit expansion diminishes since more and more new money is required for debt-service. The monetization of government debt locks the system into a death spiral.

To me, this is the only debate topic that truly matters because this alone has the power to drastically reduce the standards of living of hundreds of millions of people regardless of what happens with any other issue.

But of course you can’t talk about the inner workings of a debt-based monetary system and still produce the riveting sound bites necessary to keep nearly 100 million people glued to their television screen. It took me all morning just to write about it, partly because it is so boring that I kept thinking about all of the other things I could be doing with my time.

I suppose the fact that there is no true political solution to this problem is a factor also. It’s hard to stand up and tell people its broke and unfixable, and then say: Vote for me!

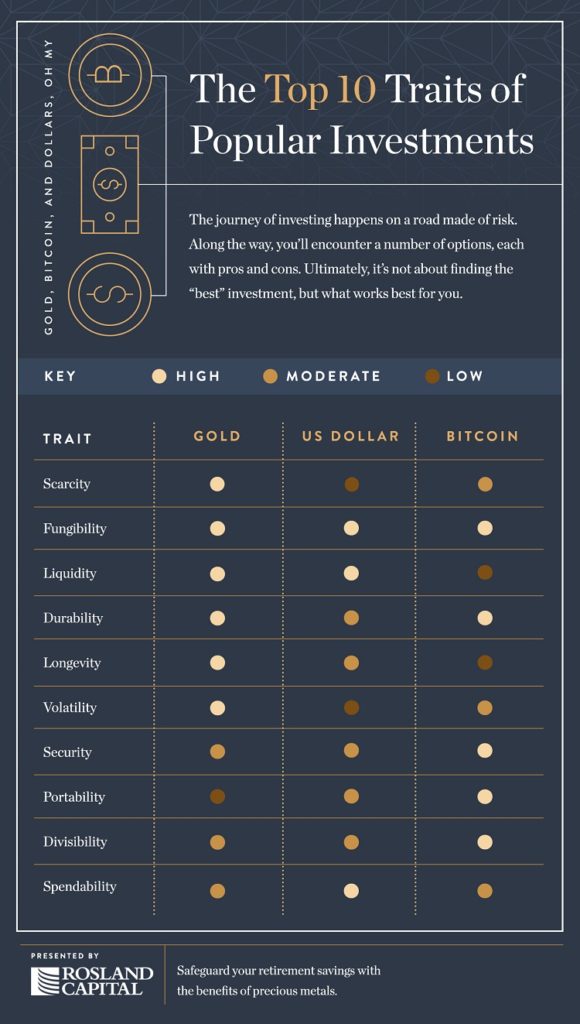

Fortunately, you don’t need political solutions… you can create your own solution. Take a look at this graphic created by Rosland Capital from some information on their gold IRA page.

This graphic illustrates why both gold and Bitcoin are superior to the U.S. dollar, both as a monetary instrument and as an asset class.

One of the first steps towards creating your own solution to the inevitable problems associated with the unfunded liabilities is to build a healthy position in both gold (and silver) and Bitcoin as part of an antifragile asset portfolio. For me, I think precious metals should make up at least 10% of an asset portfolio. For Bitcoin, I think 3-5% is a good benchmark.

As the dollar continues to devalue, I think we can absolutely expect to see higher prices for both gold and Bitcoin in dollar terms. So we are basically shielding our capital from the ill-effects of Uncle Sam’s debt binge and the Fed’s monetary inflation.

Gold and Bitcoin are the only two financial assets that are not simultaneously someone else’s liability. More accurately, they are the two financial assets that hold no counterparty risk. Compare this to the U.S. dollar, whose primary counterparty is $19 trillion in debt with accrued liabilities totaling $200 trillion.

Currencies come and go, but the precious metals are constant. J.P Morgan himself testified before Congress in 1912: “Gold is money. Everything else is credit”. I suspect the day will come when that statement will apply to Bitcoin as well.

We offer a primer on asset allocation to all members of the Zenconomics Report, including how to acquire and manage these assets. Additionally, our monthly newsletter is focused on how to leverage these macroeconomic trends in your favor to build a small fortune over the next 3-5 years.

You don’t have to be a victim to the monetary madness that is playing out in real time. Educate yourself, master your finances, build an antifragile asset portfolio, work towards financial escape velocity, secure your digital communications, and utilize participatory Gamma systems where relevant, and I think you can create a brilliant future for yourself regardless of what the rest of the world does. These are all items we cover in the Zenconomics Report.

Ralph Waldo Emerson wrote: “The good news is that the moment you decide that what you know is more important than what you have been taught to believe, you will have shifted gears in your quest for abundance. Success comes from within, not from without.”

It’s your call…

More to come,

Joe Withrow

Wayward Philosopher

For out-of-the box coverage of market updates, major events in the financial markets, the evolution of monetary policy, and how to position your finances to benefit from developing macroeconomic trends, please join the Zenconomics Report!

We also track a small portfolio of stocks according to the Beta Investment Strategy, and the monthly newsletter explains how we think anyone can build a small fortune over the next several years by catching a major financial trend that is just now beginning to play out.

As a bonus, we include a report detailing everything you need to know about managing an investment portfolio in our Assess, Mitigate, Implement, and Prosper, and we also include a 28-page guide to the Information Age with all new subscriptions.

To join the Zenconomics Report mailing list, simply subscribe below or at https://www.zenconomics.com/report: