One of the books making waves in the finance space right now is David Webb’s The Great Taking. It posits that the global elite have reworked the legal system such that they are now the secured creditors for all financial assets and all the underlying property held by publicly-traded corporations.

According to Webb, the global banking cabal plans to set off another great depression – similar to what happened in the 1930s. This will cause a financial collapse and allow the elites to legally transfer all wealth to themselves.

Afterwards, we’ll wake up to find that we don’t actually own the stocks and funds held in our retirement and brokerage accounts. The middle class will be wiped out. Then, if we want to get back into the new financial system, we’ll have to consent to using a programmable central bank digital currency (CBDC).

The book suggests that the Federal Reserve’s (the Fed’s) aggressive rate-hiking campaign of 2022 was part of this plan. It was the trigger. Higher interest rates are what will cause the collapse and set the plan into motion.

It’s an entertaining story. But I don’t think it correctly identifies the incentives.

If we look at the numbers, the great taking already happened.

It started in 1971 when President Nixon cut the dollar’s final link to gold. That thrust the world onto a fiat monetary standard.

This allowed governments to create currency units from thin air… which effectively transfers purchasing power from market participants to those who get to use the newly created currency first – the insiders in each country.

That’s just basic supply and demand economics. The more currency units created from nothing, the less purchasing power each unit holds. We see this in the form of rising prices across the board.

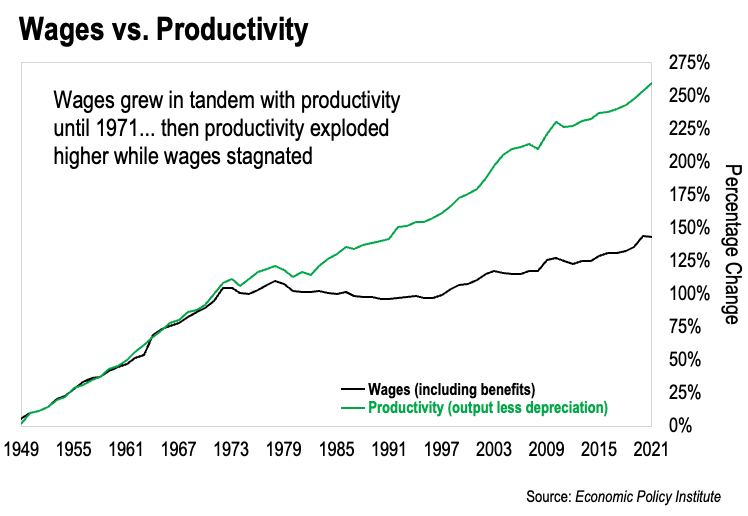

This chart tells the story for America:

This depicts inflation-adjusted wage levels compared to annual productivity in the US. Wages are the black line – we can think of this as a proxy for the American middle class.

And we can see very clearly that wages rose in lock-step with productivity every year until 1971. Then productivity kept marching higher… but wages stagnated when adjusted for inflation.

That’s the great taking at work.

The fiat monetary system transferred all productivity gains to the US government and its favored institutions. This effectively eradicated the middle class. But it did so in such a way that nobody realized what was happening.

It was a gradual taking that took place over decades.

But then it accelerated in 2008. That’s when the world’s central banks colluded to cut interest rates to zero.

And make no mistake about it – that was coordinated. Only by working together could central banks enact their zero interest rate policy (ZIRP).

And ZIRP set off what the great Austrian economist Ludwig von Mises referred to as a “crack-up boom”. Free money created from nothing hollowed out the real economy, financialized everything, and sent asset prices (real estate/stocks/bonds) skyrocketing.

Those who got to use the newly-created money first bought these assets before they shot up in price. But the rest of us didn’t get that luxury. And we had to grapple with a rising cost of living at the same time.

The result is that it became harder and harder for regular folks to save money and accumulate assets.

The Fed conducted an “economic well-being” study in 2022. It showed that 37% of American households can’t afford any unexpected expenses greater than $400.

That means a large percentage of the population lives month-to-month.

And today, even people earning “six figures” (over $100,000 a year) struggle to come up with a down payment for a home. Because in many cities a nice home costs well over half a million dollars.

So fiat money and ZIRP are what executed the great taking. They are the disease that wiped out the middle class.

Normalizing interest rates is the cure.

Don’t get me wrong – I’m no fan of the Fed. Central banking is a blight upon the world. But it’s clear to me that the Fed broke ranks under Jerome Powell. Powell made a conscious decision to normalize interest rates.

That’s what the Fed’s aggressive rate-hiking campaign in 2022 was about.

Powell threw ZIRP into the garbage where it belongs. And he powered forward with rate hikes even with everybody yelling at him to stop.

If we remember, the United Nations (UN) issued a statement in October 2022. That statement was directed at the Fed. It called on all central banks to stop raising rates. This signaled that the globalists did not want to end the age of coordinated monetary policy.

Powell ignored them completely.

Now, the Fed’s rate-hiking campaign guarantees that we’ll have a recession. I have no doubt about that. But a recession is exactly what we need. It is part of the cure.

More on that tomorrow…

-Joe Withrow

P.S. I spent quite a bit of time trying to connect the dots when the Fed first began hiking rates. At the time, most analysts were saying it wouldn’t last, and that the Fed would “pivot” at the first sign of trouble.

But my research revealed that the Fed wasn’t just raising rates to fight inflation. It’s aim is much bigger. And I found that the Fed has clear incentives to normalize interest rates and oppose the globalists.

If you’re into this kind of thing, I laid it all out in my book Beyond the Nest Egg. You can find it on Amazon right here.