submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

The Future of Money

May 18, 2016

Hot Springs, VA

“Just like the Internet gave information back to the people, Bitcoin will give financial freedom back to the people. But that’s only the first step… Bitcoin will allow us to shape the world without having to ask for permission. We declare Bitcoin’s independence. Bitcoin is sovereignty. Bitcoin is renaissance. Bitcoin is ours. Bitcoin is.” – Julia Tourianski

The S&P closed out Tuesday at $2,047. Gold closed at $1,280 per ounce. Crude Oil closed at $48.54 per barrel, and the 10-year Treasury rate closed at 1.759%. Bitcoin is trading around $457 per BTC today.

Dear Journal,

Wife Rachel: Honey, look! Madison has a pet caterpillar in this jar! She put leaves and twigs in there so it can eat and turn into a butterfly…

Philosopher Joe: Oh… why does it look like all of the oxygen has been sucked out of the jar?

Wife Rachel: What do you mean…?

Philosopher Joe: Did you punch holes in the top to let air in?

Wife Rachel: Wha… oh crap.

Spring is in full swing here in the mountains of Virginia. The caterpillars are crawling, the butterflies are flying, the wildflowers are blooming, and the all-encompassing green foliage is a bright celebration of new life!

Pretty soon it will be time to dust off the kayaks and enjoy the serenity that is the crystal-clear waters of the Jackson River as it snakes through the highlands of the Virginia-West Virginia border. Not too long after that, the leaves will light up the sky with majestic shades of red, orange, and yellow, and the crisp morning air of Autumn will breeze in.

I don’t think I appreciated the changing seasons much in my younger days. At least I didn’t think much about them. Today, I marvel at the spontaneous order of nature’s cycles. They remind me that there is a time and a place for everything. They also remind me that nothing lasts forever.

The concept of complete impermanence is a difficult one for humans to accept. We tend to suffer from the normalcy bias – the notion that tomorrow’s world will be the same as today’s.

But impermanence is everywhere. Each of us are alive on this Earth for a very short period of time, and our entire world is constantly changing while we are here. We grow up, strike out on our own, watch our parents age, have children, and watch them grow. Then our children grow up, leave the house, and watch us age. Like nature, life is cyclical.

As it turns out, much of human civilization is cyclical as well. We watch the economy go through boom periods, and then bust periods. Everyone expects the boom to last forever… until it doesn’t. Then everyone expects the bust to last forever… until it doesn’t.

While an economic boom is taking place in one location, a bust may be unfolding simultaneously in another. Go to San Francisco today and you will see a booming economy in full throttle. Go to Detroit and you will see what a major bust looks like. Yet Detroit was likely one of the best places in the world to live a short fifty years ago or so.

Such cycles are especially obvious in the realm of politics. The U.S. government is the world’s dominant empire today. That title was claimed by Great Britain a century or so ago, while the U.S. was a tiny little republic. Before Britain it was Spain… and Rome… and Egypt… and certainly several others in there somewhere as well. Political power, like the moon, waxes and wanes.

However, there is one very notable thing that discernibly does not go through cycles – technology. Technology does not boom and bust; it accretes.

You can look back through history and see that our agricultural technology did not go through boom-bust cycles; it got consistently better over time. As did blacksmithing technology, industrial technology, transportation technology, electrical technology, engineering technology, medical technology, communication technology, computer technology, and information technology. Despite the booms and busts in politics, economics, and other socio-cultural matters, technology has continued to accumulate and improve human civilization.

By the way, this idea is not original to me. Paul Rosenberg over at the Freeman’s Perspective mentioned this in an tech-related podcast I happened to tune into and I thought it was a brilliant observation.

Here’s where I want to run with the idea: humans can rarely see a year out in time – much less a decade or more – but the accretion of technology consistently alters the very mechanics of society time after time – often radically.

Back in 1894, the Times of London ran an urgently serious article suggesting that every street in the city would be buried nine feet deep in horse manure within several decades time. This was an immensely reputable publication at the time published by very serious people. They were very concerned about horse manure in their streets.

By 1911, Model T’s were rolling off the assembly line at Ford of Britain’s factory in Manchester, and London’s horse manure problem would soon disappear entirely. The Times could not conceptualize such a radical change less than two decades prior. I doubt I would have foreseen mass-produced cars coming, either.

Here’s what I do see coming: the Great Reset.

I have written about the inevitability of a currency crisis time after time. I have written about this so much that Wife Rachel just deletes the email feed whenever she sees a journal entry about the monetary system come through.

To many, the notion that the modern central banking system is fragile, and that their money is more-or-less fraudulent is ridiculous. After all, an honest study of monetary history is decisively lacking from all major educational curriculum so most people just assume money is money is money – always has been and always will be. But there’s a whole lot more to the story.

You can bet the political class and the central bankers will have a new monetary system ready to roll for when the current system fails. You can bet that the new system will be another centralized monopoly which gives governments and central banks complete control over the money supply – complete control to create currency at will, that is. There may be a lot of rhetoric about reform, but these monolithic institutions cannot finance themselves without the ability to create money out of thin air.

Proponents of Austrian economics have espoused the merits of an honest gold standard for years in hopes of influencing monetary reform. The primary reason? Gold prevented governments from consolidating power, and it prevented the central bankers from destroying the value of the currency through inflation.

There was a glimmer of hope for hard-money advocates back in 1982 when the U.S. government authorized a gold commission to evaluate the role of gold in the monetary system.

As it turns out, the commission was dominated by people who favored fiat money and a return to gold was never seriously considered. This isn’t too surprising in hind-sight. The pro-gold minority on that commission – Ron Paul and Lewis Lehrman – were essentially suggesting reforms that would significantly curtail the power of government and the wealth of the banking cartel.

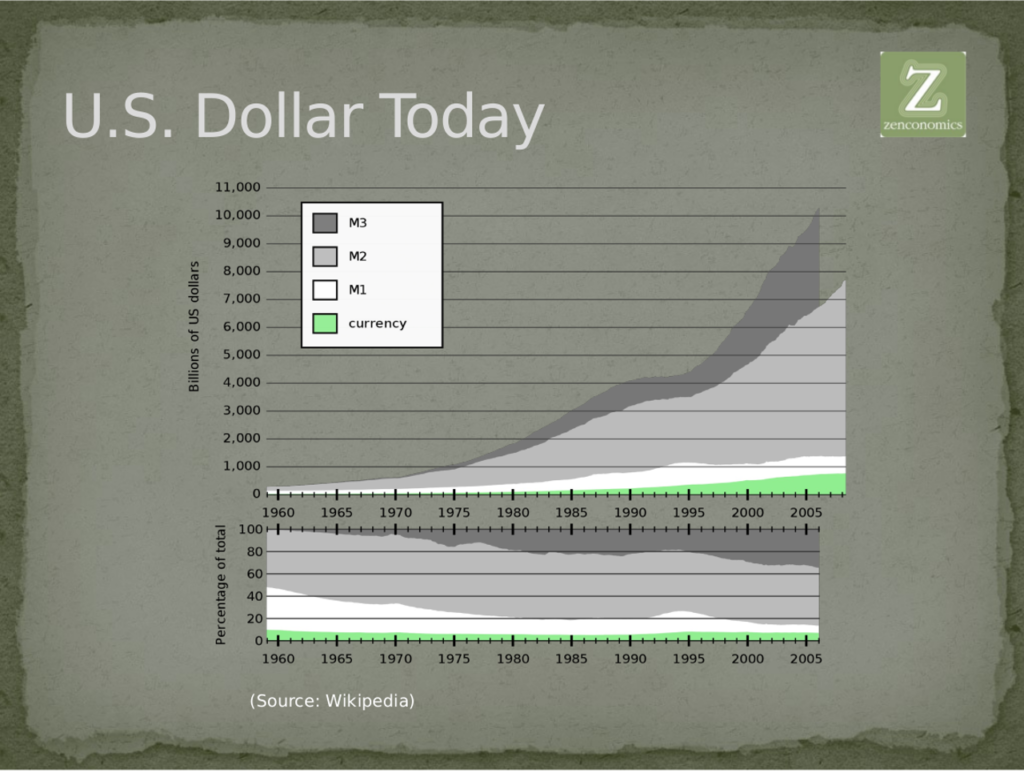

This seemed to embolden the controllers of the fiat system, as they thenceforth embarked on an unprecedented monetary expansion. This chart clearly shows how the money supply has more than tripled since 1982.

So the next official monetary system is coming when this one finally hits the wall, but that system is not the future of money.

A different kind of monetary system arose quite literally from the ether during the peak of the 2008 financial crisis. This new money is completely digital, completely decentralized, completely distributed, and completely peer-to-peer. It was not created by governments, banks, or any institution whatsoever; this new type of money was created by open-source computer code. The new money is not created and issued by a centralized institution, but rather it is “mined” into existence by individuals voluntarily comprising a distributed network.

The technical term for this new type of money is cryptocurrency, of which Bitcoin was the first and remains the most prominent to this day. Bitcoin is more portable, divisible, and fungible than any medium ever used as money previously.

In a digital sense, Bitcoin is extremely durable as well. The distributed nature of the platform means that the software is not run from a centralized server owned by a single entity; the software is run on millions of computers all around the world. The true brilliance of Bitcoin is the network effect – there is no single point of failure.

This means that Bitcoin cannot be shut down. It doesn’t matter how much political power is aimed at it, the Bitcoin network cannot be stopped short of taking down the entire Internet. All of modern civilization is dependent upon a functioning Internet, however, so we are talking about a new dark age should the Internet ever disappear.

Also, personal bitcoins are extremely secure so long as users follow simple good practices. These factors provide a high degree of durability in a digital world.

I first learned about Bitcoin back in 2012, and I immediately dismissed it. As a proponent of Austrian economics, I considered gold and silver to be the best forms of money so I wrote this digital currency off entirely.

Talk about opportunity cost! Bitcoin was trading under $10 back then, which means every $2,000 put into Bitcoin is worth $100,000 today.

But the dollar exchange rate is not what is important; what’s important is the potential. I was sold on this as soon as I actually used Bitcoin.

The Bitcoin network is like a banking system except there are no banks and in fact no central authority whatsoever. It is entirely peer to peer which means you have full control of your money – bitcoins – at all times and in all places. You hold your bitcoins in a wallet that can be housed on an exchange, on your hard drive, or on a flash drive. Your wallet is secured with a pair of public/private keys. The public key is what others see when you transact with bitcoin. The private key is what is fully encrypted to provide security. There are numerous exchanges that have popped up providing conversion services to enable you to convert your bitcoin into dollars, euros, yen, or other currencies and vice versa.

Bitcoin gives you complete payment freedom – you can send your bitcoins to anyone, anywhere, at any time with the click of a button. There are no banks, no bureaucrats, and no border restrictions to contend with.

These transactions are encrypted, irreversible, and do not require identifying information to complete. Because the Blockchain validates and timestamps all transactions, party A does not need to know party B in order to trust that the transaction will be legitimate. This is known as a “trustless” system because the transacting parties do not need to trust one another in order for their transactions to be secured and validated. This eliminates fraud, chargebacks, administrative costs, and identity theft.

Bitcoin is digitally “mined” into existence using software that solves difficult cryptographic problems. Anyone can download this software and mine Bitcoin, but it now requires huge amounts of computing power thus making it a very difficult process. This serves to regulate the rate at which Bitcoins enter the network. Further, there are only 21 million Bitcoins that can ever come into existence and more than half of those have already been mined. This fixed quantity is hard coded and cannot be unilaterally changed.

Bitcoin is part of the peer-to-peer open source movement which means its code is 100% transparent and visible to everyone. All decisions are made through the network – no one owns Bitcoin and no one can make unilateral decisions. Bitcoin is constantly being maintained and developed, but any changes to the code must be accepted by a majority of the global network or else the updates will not stick.

What all of this means to me is that Bitcoin provides for a monetary system that is equally as honest as a true gold standard, but more convenient and incorruptible. This monetary freedom is  available to anyone who would like to use it, but it is completely optional. No one is forced to participate. Those who would prefer to use their fiat money are free to do so.

available to anyone who would like to use it, but it is completely optional. No one is forced to participate. Those who would prefer to use their fiat money are free to do so.

Bitcoin is very much in alignment with the principles of voluntarism in this manner. And guess what? No political reform or permission was needed! That’s freedom.

Additionally, numerous other cryptocurrencies have been developed – each with differing strengths designed to compliment Bitcoin and provide for even more flexibility. Several of these other currencies are now worth more than a U.S. dollar.

What would you say if you saw a completely decentralized, comprehensive, superior monetary system that was not subject to the whims of governments, politicians, bankers, or financiers?

I would say you were looking at the future of money. This will require scalability and mass-adoption, so I may be wrong about this. I still allocate a significant percentage of my assets to precious metals because I think they still have a role to play.

But we know that technology radically alters human civilization over and over again, and this looks like the most powerful self-empowering technology since the Internet…

More to come,

Joe Withrow

Wayward Philosopher

Please see the Zenconomics Guide to the Information Age if you would like to learn more about Bitcoin. We talk about how to open a Bitcoin wallet, how to use Bitcoin exchanges, and we recommend several reputable exchanges and wallets. We also discuss security and a good practice items. We are offering a free copy to all new mailing list subscribers at this link: Zenconomics Report Free Registration.