When we left off yesterday, we were talking about interest rates… and hoping it didn’t put everybody to sleep.

All the talk in the financial world (geopolitics aside) has been the Fed’s 50-point rate cut.

Does it signal that the easy money days are coming back again? Are small-cap stocks finally going to catch a bid? Are 3% mortgages coming back?

Before we project too far, I think it’s important to point out that the Fed can only influence short-term interest rates with its monetary policy decisions. It cannot magically “set rates” throughout the economy.

As evidence – both the 10-year and the 30-year Treasury bond rates went up after the Fed’s 50-point rate cut.

The 10-year Treasury rate was 3.62% on September 16th – two days before Powell’s announcement. By September 23rd, the 10-year rate had jumped to 3.75%. It increased 13 basis points.

The 30-year Treasury rate was 3.93% on September 16th. It spiked to 4.13% in the days after the Fed’s rate cut. That’s a move of 20 basis points.

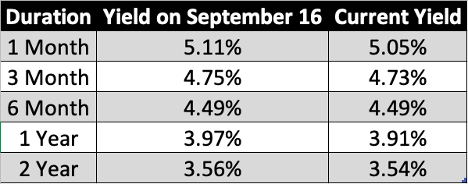

Meanwhile, shorter duration Treasuries have hardly moved since the Fed’s rate cut.

Source: Bloomberg

This shows us that the Fed’s rate cut was already priced into the market. Short term Treasury rates have not fallen much since the big announcement.

Yet, long-term rates have risen materially. In financial lingo, this is known as the “bear steepener”.

The term “steepener” refers to long-term rates rising faster than short term rates. And “bear” refers to the fact that this movement typically happens when the market expects higher inflation and/or slowed economic activity in the near future.

This is especially true when the bear steepener move results in an un-inverted yield curve… which is what we’re seeing right now. And that brings me to my thoughts on Powell’s 50-point rate cut…

I’ve seen quite a few articles floating around the “alternative finance” space suggesting that Powell caved to the Deep State and that he’s trying to influence the election. I’ve also seen suggestions that the Fed is going to slash rates aggressively from here.

I don’t think any of that is true.

Powell said two things in his talk this month that I found interesting. And if we take Powell at his word, his comments are quite telling for what’s to come.

More on that tomorrow…

-Joe Withrow

P.S. My running thesis is that Jerome Powell’s Federal Reserve is fundamentally different from the Fed under his predecessors Janet Yellen and Ben Bernanke. In fact, I’m confident in saying that the Fed’s monetary policy was not independent previously.

But a silent coup occurred within the Eccles building in 2018… and that set into motion a 4-year plan to liberate US monetary policy. And I must say – it certainly appears this plan has gone off without a hitch. That’s what’s so interesting about Powell’s tenure as Fed chair.

For more on that silent coup… how the plan unfurled… and how we should view our only finances accordingly, see my book Beyond the Nest Egg. You can get it on Amazon right here: https://www.amazon.com/Beyond-Nest-Egg-Financially-Independent/dp/B0CGG5G6XH/

One thought on “The Fed Cuts… Rates Go Up”

Comments are closed.