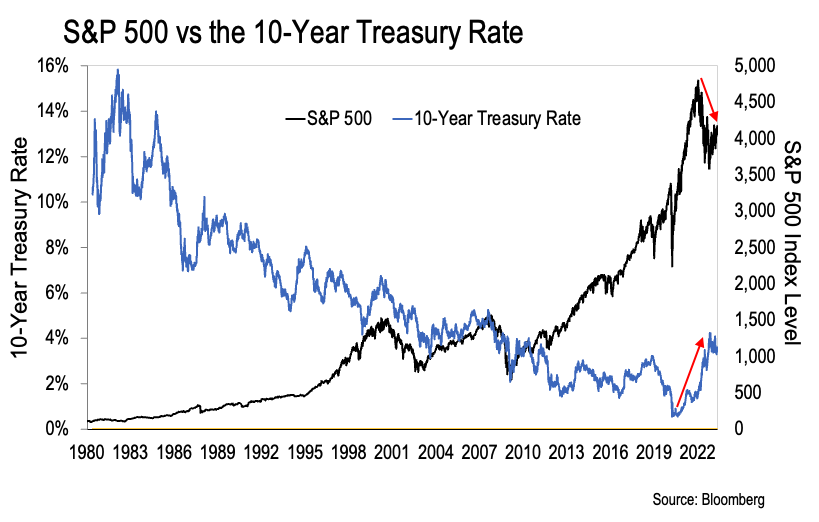

As regular readers know, my thesis is simple. The Age of Paper Wealth is over. This chart tells the story:

Here we can see the S&P 500 and the 10-year Treasury rate going back to 1980. The S&P 500 is the black line. And the 10-year Treasury rate is the blue line.

We’re using the S&P 500 as a proxy for US stock prices. And we’re using the 10-year Treasury as a proxy for interest rates. This chart makes it perfectly clear that the two are inversely correlated.

Interest rates started falling in 1982, and they fell consistently for the next 40 years. Meanwhile, US stocks consistently went up in value over that same time period.

But everything reversed in 2022. Rates started going up, and stock prices started to fall. We can see those moves clearly marked by the red arrows on the chart above.

So the period from 1982 to 2022 will go down in history as the Age of Paper Wealth.

And here’s the thing—what happened from 1982 to 2022 was not normal. Nor was it organic.

Instead, it was all driven by the debasement of our money.

The US government and the Federal Reserve (the Fed) worked hand-in-hand to create over $8 trillion dollars from thin air during this time period. We can verify that $8 trillion because it hit their balance sheet.

There’s also strong evidence that the Fed collaborated with other major central banks to create over $20 trillion off balance sheet in the wake of the 2008 financial crisis.

This activity drove interest rates down and stocks up.

As we discussed yesterday the Fed has a vested interest in reversing course. It needs to normalize interest rates to save the legacy financial system.

But some readers want to know – what if this thesis is wrong? What’s to say the Fed can’t get right back to their same antics?

It all comes down to the law of diminishing marginal utility.

The law of diminishing marginal utility states that as consumption increases, the utility derived from each additional unit declines. In the context of the Fed Put, this principle suggests that each additional round of stimulus has a smaller impact than the last.

The Fed Put began in 1987 under Fed Chairman Alan Greenspan.

In response to the Dow Jones Industrial Average falling over 22%, Greenspan cut interest rates to inject liquidity into the financial system. That set the precedent.

Going forward the Fed cut rates every time the stock market began to correct. In total it cut rates 47 times from 1990 through December 2008. When it was done, the Fed’s target rate was at zero.

What happened next illustrates the law of diminishing marginal utility very clearly.

In 2008 the Fed pumped $1.3 trillion into the financial system to effectively bail out the banks. That’s what it took to liquify the system and stop the stock market from plummeting.

But then when Covid-hysteria ramped up and the stock market crashed in 2020, the Fed had to pump over $3 trillion into the system to stop the bleeding. It took more than twice the amount of “stimulus” to back-stop the markets.

That’s the law of diminishing marginal utility at work. And there’s another nuance to it all that makes it finite.

Today our money comes from debt. By that I mean every new dollar created also creates an associated debt obligation.

When the Fed wants to pump money into the financial system, it does so by purchasing US Treasury bonds. And that means the US government must make interest payments to the Fed.

Sure, the Fed returns a portion of those interest payments back to the Treasury each year after it pays its own operating expenses.

But that doesn’t change the dynamic. The more money the Fed prints, the higher the US debt goes—driving up the Treasury’s annual debt service costs.

And that impacts the US government’s credit rating.

This is important because it influences real market actors. The more shaky the US credit rating is, the less foreign central banks and institutional investors will want to buy its bonds.

So at the end of the day it’s all a confidence game.

The Fed and the US Treasury have gotten away with creating trillions of dollars from nothing thus far. But that doesn’t mean they can do this forever.

The market will set limits… and Jerome Powell knows this.

That’s why he made a conscious decision to kill the Fed Put. It’s all about shoring up confidence in the system—a system in which the Fed and the New York banks benefit from tremendously.

-Joe Withrow

P.S. Stay tuned for a major announcement next week. I’ll be unveiling an opportunity that will help you navigate these complex financial waters. Don’t miss out on this chance to gain a deeper understanding of the economic landscape and learn how to protect and grow your money in these uncertain times.