May you be blessed to live in interesting times.

The above line is an ancient Chinese proverb… and it absolutely applies to us. My friends, we are at an inflection point in history. Right now.

There are many reasons why that’s the case. But I’m a finance guy, so I’ll focus on the financial aspects. We’ll start with some quick background…

The Federal Reserve (the Fed) is the central bank of the United States. And it owes its existence to a piece of legislation that passed in 1913.

The story of how that legislation was crafted and pushed through is absolutely incredible. If you like mystery novels, the story of the Fed is for you. But we’ll save that for another day.

Today, the Fed claims to have a dual mandate. It’s to ensure maximum employment and price stability.

Between friends, that mandate is bunk. The Fed does neither. Nor is it supposed to.

The Fed’s true purpose is to ensure that the U.S. Treasury is forever solvent… even if it spends money that it doesn’t have.

In other words, the Fed’s job is to print money to cover the U.S. government’s excessive spending. We call this “debt monetization”.

But there’s a new wind blowing out in front of the Eccles building. And it seems the Fed has made a conscious decision to break from the Treasury.

Fed Chair Jerome Powell was on Capitol Hill this week. And he made it abundantly clear that the Fed is no longer going to cover for the Treasury’s malfeasance.

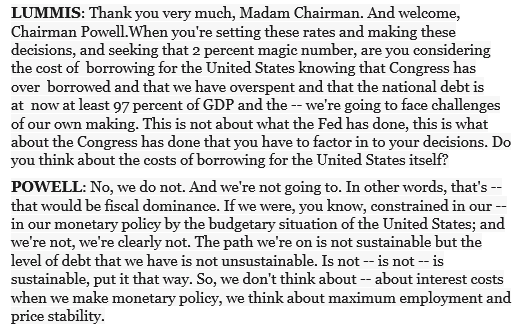

Check out Powell’s exchange with Senator Lummis:

As we can see, Powell made it very clear that the Fed is not going to keep interest rates low just to help the U.S. Treasury service the national debt.

Sure, he paid lip service to the dual mandate. He has to. But the big takeaway is that the Fed’s not going to support the deficit by keeping rates low.

I know this confused many analysts. It would have confused me a year ago as well.

After all, Powell succeeded Janet Yellen as Fed Chair. And Yellen happens to be the head of the U.S. Treasury now. Aren’t they on the same team?

The answer is no.

The fact is, there’s a power struggle happening in this country right now. This has become apparent over the last twelve months… at least for those who cared to read between the lines and analyze incentives.

Yellen is aligned with what we’ll call the globalist power structure. It seeks to reorganize our society per the World Economic Forum’s “stakeholder capitalism” model.

It’s intended to sound like a friendlier version of capitalism. But in reality stakeholder capitalism is more akin to a grotesque neo-feudalism.

That’s because the “stakeholders” in their vision will control all aspects of money, finance, and energy production.

This necessarily requires the commercial banking system to be diluted or discarded. And it takes all decision-making authority and places it in the hands of the stakeholders. The rest of us are expected to fall in line and accept their edicts.

Meanwhile, Powell is aligned with the New York banking interests. They have been prominent for over a century now. This is the power structure that helped get the Fed established in the first place.

This faction wants to maintain the American status-quo as it currently exists. In fact, their power, wealth, and influence depend on it.

There’s very clear evidence that these two factions have been battling it out for at least twelve months now… maybe longer. Except everything’s happening just under the surface. Most are unaware that anything like this is afoot.

And with Powell’s overt comments on Capitol Hill this week, it’s clear the battle is ramping up. This is the first time Powell publicly admitted that the Fed has broken ranks with the Treasury and the globalist narrative.

So things are about to get especially interesting. And this all has major implications with regards to money and investing.

First of all, understanding what’s happening at the macroeconomic level enables us to make intelligent decisions when it comes to our investments.

Most of the financial world has been stuck in this echo chamber where they are repeating the same thing to each other. They all agree that Powell is raising rates in the present to fight inflation… and that he will “pivot” and cut them again when inflation subsides.

That’s not what’s happening here.

The Fed isn’t raising rates to fight inflation. It’s raising rates to fight the globalist power structure… and to preserve the power and prestige of the New York banking scene.

That’s a deep rabbit hole. And we cover it in a lot more detail in The Phoenician League’s monthly newsletter.

But for investors, the takeaway is this: the days of low rates and easy money are over. The Fed will not support the stock market anymore.

In other words, the Age of Paper Wealth has ended.

And that means what’s worked well for the last several decades won’t work so well going forward. It’s time for a new approach…

-Joe Withrow

P.S. If the battle between the Fed and the Treasury piques your interest, we are actively tracking this story every month in The Phoenician League’s monthly newsletter.

We’ve already spilled tons of ink on the subject – about ten thousand words to be precise. And we’ll continue to do so going forward.

Simply put, this is the most important macroeconomic story of our day. Yet, very few people even know what’s happening… let alone understand it.

In The Phoenician League, we also talk extensively about how to position our investments in response to the major changes that are afoot right now.

This includes robust asset allocation and an intense focus on building passive income streams. And we have specific investment suggestions and a systematic process for going about this.

The Phoenician League only opens its doors to new members a few times each year. And our recent enrollment period ended last Saturday.

That said, we can still accommodate a few new members in the current cohort. So I’m going to make an exception and extend one final opportunity to join our network at a discounted price.

If you’re at all interested in our offering, just go here:

The Phoenician League Membership Program

You can use coupon code member25 at the checkout page to take 25% off of our membership rate. This will be the very last time we extend this discounted offer.