People seeking financial independence today face immense challenges that their parents and grandparents did not. This is especially true for those approaching retirement.

From our perspective there are two major items that trump the rest. They are low interest rates and soaring inflation.

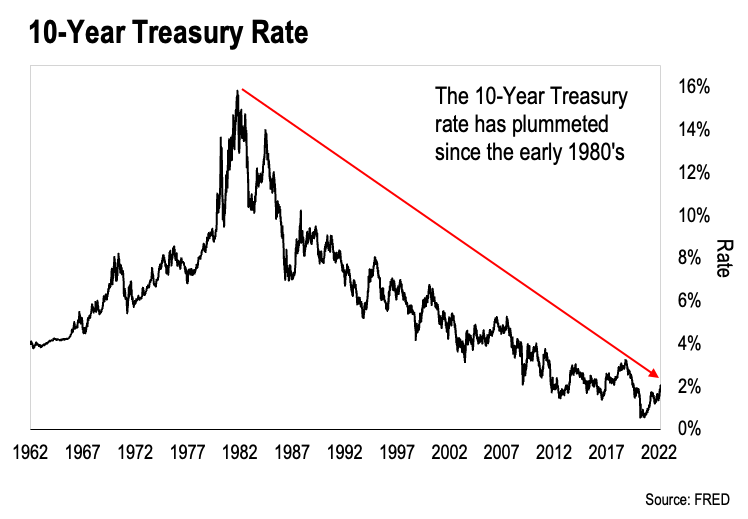

We’ll start with interest rates.

In August of 2020, the 10-Year Treasury rate – the interest rate paid by 10-year U.S. Treasury bonds – fell to 0.52%. Half a percent.

For comparison, even at the peak of the 2008 financial crisis 10-Year Treasuries still paid 2.2% interest. And that was considered unbelievably low at the time.

Sure, rates have rebounded from their 2020 lows. But they are still in the dumpster. This chart tells the story:

As we can see, the 10-Year Treasury rate is still lower than it has ever been in modern history. And that has a direct impact on all other interest rates in the economy.

As I write, the best certificate of deposits (CDs) at U.S. banks are paying less than one percent on deposits. And the top savings accounts in the U.S. yield less than 0.7%.

These returns don’t come anywhere close to keeping up with inflation. That wasn't the case a generation ago. These were once viable, conservative ways to save for retirement.

So we are in uncharted territory here. And there are wide-ranging implications.

Let’s talk about how this impacts retirees…

In the old days, retirees would put a chunk of their savings into CDs and savings accounts at the bank. These were “safe” investments. They protected the original capital first and foremost. And they also paid a small rate of interest that outpaced inflation.

Pair this with their Social Security income and retirees could afford a comfortable quality of life. They never had to worry about money again.

Those days are over.

As we noted, CDs and savings accounts pay a pittance today. Even plowing $1 million into these accounts cannot generate more than $10 or $15,000 per year in income at today’s interest rates. And that’s before taxes.

Perhaps retirees can pair this income with Social Security to meet their basic living expenses. But this certainly is not the path to a comfortable retirement.

What’s more, inflation is going to run wild in the coming decade. And that means the dollar’s purchasing power will fall dramatically. This is our second major challenge…

The term “inflation” is thrown around quite a bit today. If you ask somebody what it means, they will tell you rising prices. But if you ask them what causes inflation, most people can’t give you a meaningful answer. So let’s demystify it for a minute.

First of all, I am sympathetic to the definition put forth by the Austrian School of Economics. Inflation is the expansion of the money supply. It is the act of creating new money and injecting it into the economy.

If we speak from a dollar-centric point of view, inflation occurs when the Federal Reserve (the Fed) pumps new dollars the system. These dollars then have to go somewhere. And wherever they go, we are likely to see rising prices follow.

From this perspective, rising prices are the result of inflation. They are not inflation itself. And prices do not rise in a uniform manner.

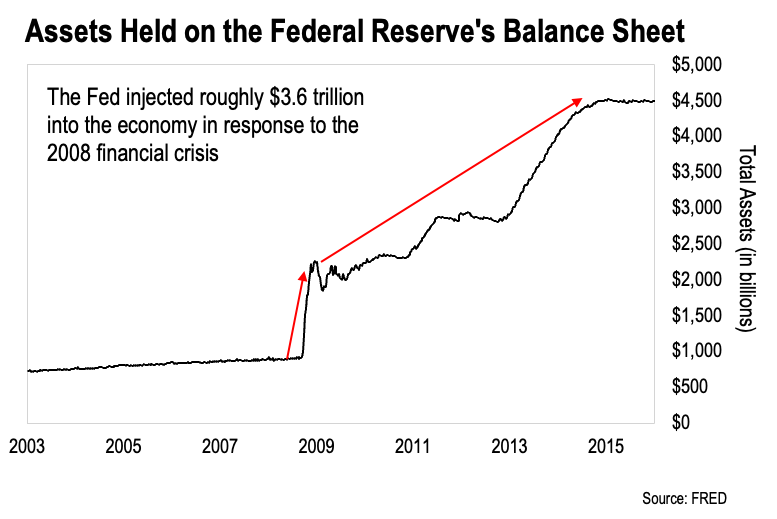

The Fed pumped over $3.6 trillion into the financial system in response to the 2008 financial crises. Again we’re talking about new dollars created from nothing. Here’s the chart:

This is a chart of the assets on the Fed’s balance sheet. These consist mostly of U.S. Treasury bonds, though the Fed bought a bunch of mortgage-backed securities in the wake of the 2008 crisis as well.

That’s what we’re seeing here. When the line goes up, the Fed is creating new money to buy these assets.

Let’s use August 2008 as our starting point here. At that time the Fed held $898 billion in assets. Fast forward to January 2015 and that number hit $4.5 trillion.

So the Fed created roughly $3.6 trillion from thin air to buy U.S. Treasuries and mortgage-backed securities. When those transactions settled, the new money was injected into the system.

This was absolutely considered an extreme response to the crisis. The Fed had never initiated such aggressive asset purchase programs before.

However, we didn’t see prices for consumer goods rise tremendously in response. Instead, most of the inflation flowed into the stock market. This set off an epic boom that lasted over a decade.

From the Fed’s perspective, this was a fantastic result. Nobody ever complains about their stocks going up.

And the Fed even made an effort to gradually taper its balance sheet after the dust settled. It gradually reduced its assets from $4.5 trillion in 2015 to $4.1 trillion by 2020.

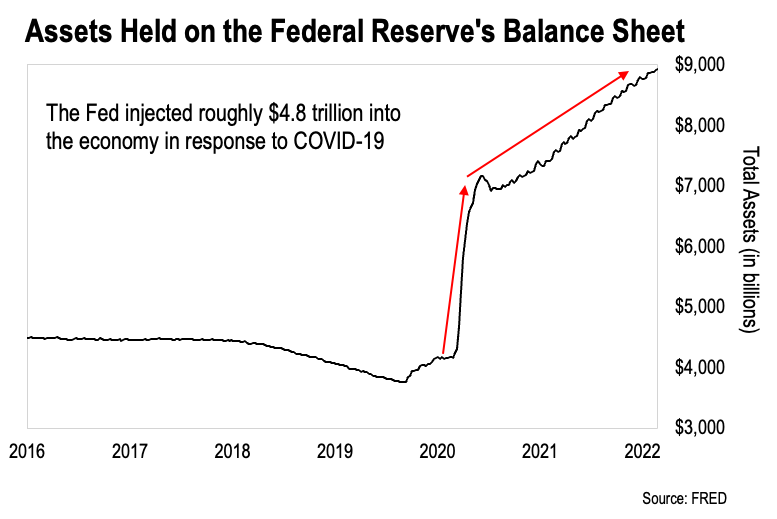

Then COVID-19 hit. And the Fed followed the exact same “crisis response” game plan. Here’s the chart:

As we can see, the Fed pumped roughly $4.8 billion into the financial system in response to COVID-19. This expanded its balance sheet from about $4.1 trillion in February 2020 to nearly $9 trillion by February 2022.

What’s more, the U.S. Treasury directly injected several trillion more into the economy via various COVID-19 “stimulus” plans. That’s in addition to the money that the Fed pumped in.

And as we would expect, the result has been dramatically different this time around. The inflation hasn’t been contained within the stock market. Instead, the U.S. has seen vicious consumer price inflation for the first time in decades.

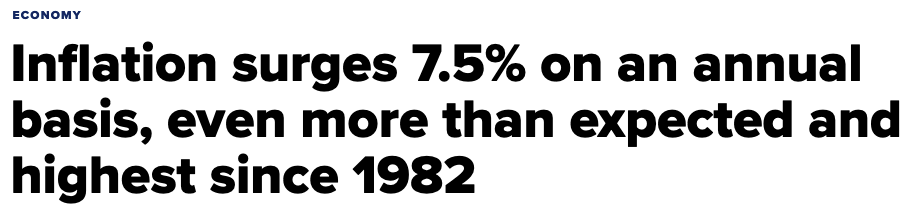

Now, the Fed’s chosen metric to measure inflation is the Consumer Price Index (CPI). And in January 2022 the CPI hit its highest level in forty years. This seemed to shock mainstream financial pundits.

And here’s the thing – the CPI is a lowball number. Consumer prices are rising at an even faster clip than it shows.

That’s because the CPI employs a replacement cost model. When the price of a particular good rises too much, the model takes it out and swaps in a comparable lower-cost good. This assumes that consumers will adjust to rising prices by changing their spending habits.

For example, if the price of steak goes up too much, the CPI may swap it out for ground beef. And sure, consumers may in fact buy more beef and less steak in this scenario.

But that doesn’t change the fact that steak prices went up. The CPI ignores this by dropping it from the model.

And that’s the whole point. The CPI always understates inflation.

That’s why assets with inflation protection mechanisms tied to the CPI such as Treasury Inflation-Protected Securities (TIPS) just aren’t adequate. It’s also why Social Security’s cost of living adjustment never seems to keep up with costs of living.

The key point here is that it is it’s impossible to generate income on traditionally safe investments today.

Plus, national “retirement” plans like Social Security are doomed. These plans will likely continue to send out checks to people for years to come, but thanks to inflation those checks just won’t buy much.

Any financial strategy that doesn’t account for these challenges is also doomed.

The good news is that there’s a solution to these financial pitfalls. In fact, financial independence is more achievable today than ever before. It just requires a deeper understanding of the financial system. This is something that we won’t find in any textbook.

To me, the answer starts with asset allocation. This refers to allocating our capital across several key asset classes according to a strategic model.

But that’s just the starting point.

Asset allocation provides us with a fundamental “base” of operations. But to become financially independent we must use that base as a jump-off point. We must create a comprehensive wealth strategy focused on building multiple streams of income. This includes utilizing complex legal entities and arcane sections of the tax code.

What we’re talking about here is drastically different from the traditional financial plan. And that’s the key.

To illustrate this, let’s talk about what’s sold as the “normal” financial plan. It’s all about retirement.

Retirement is sold as this magical period where we don’t have to work anymore. Suddenly we will be free to do whatever we want to do, whenever we want to do it.

And I know for some retirees, that is their experience. But I also know that many others are miserable. They sit around watching TV all day because they don’t have anything better to do. There’s no meaning there.

And that’s at least partly because of how we are told to plan for retirement.

The conventional wisdom tells us to save a small portion of our income throughout our working years and lock it away in “qualified” retirement plans. For wage earners, these are 401(k)s and IRA’s. The idea is that we need to get to a certain “number” that we can live on in retirement.

Maybe it’s $1 million. Maybe it’s $3 million… Whatever it is, the thinking is flawed. For a few reasons.

First off, the “number” you reach isn’t your actual number. At least not with 401(k)’s and IRAs.

Instead, you will be required to pay ordinary income taxes on every withdrawal you ever make from those accounts.

Now, if your only source of income in retirement is Social Security then you will have retired poor, and your ordinary income tax rate will be very small.

The good news there is that you won’t have to pay too much of your number out in taxes. But the bad news is that you retired poor, so you have to be very frugal with your spending. You can’t deplete your number too fast.

On the other hand, if you do have other income sources in retirement, your ordinary tax rate could be 20%, 30%, or even higher. That means you don’t have $1 million in your retirement accounts. You really have $700 or $800 thousand dollars. The rest is going to be taxed away from you the moment you try to withdraw it.

And that brings us to another major fallacy with this kind of retirement planning. The whole idea that you spend your life working to accumulate capital, only to consume that capital over your life time is both foolish and destructive. That’s my view.

Instead, the capital you accumulate should work for you. It should throw off income for you so that you never have to deplete it. You can live on the income and keep the principal intact.

That’s where your wealth strategy comes in. It shouldn’t focus on trying to get to a number. Instead, it should focus on increasing your income and generating monthly cash flow. Cash flow is king.

As for the specifics, I happen to believe that rental real estate is the way to go.

In fact, my experience is that it’s not terribly difficult to go from zero to $10,000 per month in passive income with real estate in six years or less. But that’s only if you do it right. And doing it right requires a comprehensive approach. This includes fundamental analysis, deal flow, advanced tax strategies, and sound asset protection structure.

Several years ago I launched a personal finance course called Finance for Freedom. It focused primarily on asset allocation. Building the base.

The course received great reviews from most of the people who went through it. But it lacked specifics around how to implement a wealth strategy to scale your income.

That’s largely because I was still in the process of vetting my own real estate-centric wealth strategy when the course went live. I just couldn’t speak to something for which I didn’t have first-hand experience.

Well, now I do. I have a tried-and-true strategy for generating an extra $10,000 per month in six years or less. And I am working to put it all together in a simple-to-use online course format.

In addition, I am also updating certain elements of the original Finance for Freedom course.

My plan is to package the updated version of the original course with hours of new content around rental real estate, wealth strategies, and big-picture thinking. Perhaps we will call it Finance for Freedom Reborn.

Oh, and I'll add that the additions aren't limited to rental real estate.

We talk about using max-funded life insurance, the income snowball, and Bitcoin to boost our finances and our chosen wealth strategy tremendously.

My goal here is to demonstrate a better way. Really, debt and taxes are the name of the game.

This runs counter to the conventional financial wisdom given to the middle class, but wealthy families have known this for a long time. It’s all about debt and taxes.

You see, all throughout history governments sought to control the monetary system.

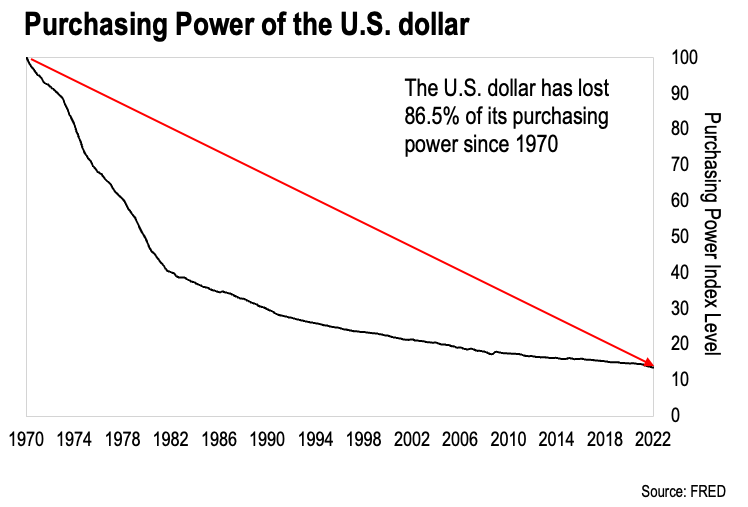

And they always use their control to inflate away the value of the currency. That’s why the purchasing power of the dollar and other fiat currencies has plummeted over the last one hundred plus years.

But look at the other side of the coin here…

As the purchasing power of the currency goes down, so does the real value of debt. Here’s what I mean...

If I owe $100,000 in debt and the purchasing power of the currency falls by 10% over the next two years, for practical purposes that reduces my debt burden to $90,000.

Sure, the number still says $100,000. But $100,000 isn’t what it used to be.

I know it’s counterintuitive, but I’ll explain this concept more. And let’s start by extrapolating this out over decades.

The U.S. dollar has lost over 86% of its purchasing power since 1970. That means $14,000 in 1970 could buy what $100,000 buys today. That’s incredible.

Now we see this practically by the fact that everything has gone up in nominal price.

Incomes, home prices, car prices, food prices… everything is up big in dollar terms since 1970. Much of that is simply a factor of the dollar’s loss of value.

It’s not more expensive to produce homes, cars, and food today. In most cases production is less costly than it was in 1970. So the rising prices we have seen are mostly explained by the dollar’s fall in purchasing power.

And think about this, it was incredibly rare for anyone to have an annual income of $100,000 or more in 1970. That was super high earner status. Today it’s not that uncommon.

This is where the magic is… the fact that incomes will rise as the dollar’s value is inflated away.

I’ll explain by applying this to real estate.

It's no secret that real estate prices have skyrocketed in recent years.

If we go back to January 2000, the median home price in the U.S. was $131,616. Fast forward to November 2021 and the median home price hit $350,350.

That means the median home price nearly tripled. Homes increased 166% in price in less than twenty years.

However, most people in the U.S. buy homes using 30-year fixed rate mortgages. Doing this locks in the principal and interest piece of the mortgage payment. And that prevents it from rising as the home's price rises.

This puts inflation to work in our favor.

Think about this – if we put 20% down on on the median home costing $131,616 in 2020, our mortgage payment (excluding taxes and insurance) would be around $772 per month. And that's assuming an 8% interest rate, which was common at the time.

If we put 20% down on the median home costing $350,350, the mortgage payment (excluding taxes and insurance) would be $1,259. That's with a 3.5% interest rate.

So even though interest rates fell by more than half, the mortgage payment on a median home increased 63% from 2000 to 2021.

Plus, both average incomes and average rents have increased dramatically as well. Put it together and mortgage payments get easier to make over time thanks to inflation.

That’s what I mean when I say that debt burdens fall as the value of the currency falls. The debt becomes easier to pay over time.

So you see, debt is a powerful financial strategy as long as you use it to acquire assets. I know it’s common middle class advice to say “get out of debt”. And that’s true when we are talking about consumer debt.

But when it comes to asset-backed debt, especially when it’s a fixed rate… we should strive to get into debt.

As crazy as that sounds… asset-backed debt is good within an inflationary monetary system like the one we have today. It puts the power of inflation to work for us. And we need to implement a wealth strategy that accounts for this.

And that's what the upcoming Finance for Freedom course is all about. For those who are interested, I will reach out by email with more information when we get closer to launch.