submitted by jwithrow.

Tag: rugged individualism

Qualified Retirement Plans

submitted by jwithrow.

Qualified retirement plans have their roots in the Employee Retirement Income Security Act (ERISA) that was enacted in 1972.

The most common qualified retirement plans are the 401(k) and the IRA (individual retirement account). These plans allow individuals to contribute funds to their account on a pre-tax basis to be invested predominantly in stocks, bonds, mutual funds, and exchange traded funds. Taxes on investment gains are allowed to be deferred until distributions from the account are taken. Individuals may begin to take distributions without an early withdrawal penalty once they reach age 59.5. Any distributions prior to age 59.5 will be subject to a 10% early distribution penalty. Individuals are required to take a minimum distribution annually once they reach age 70.5. Distributions will be taxed at the individual’s ‘ordinary’ tax rate.

Mainstream financial thinking suggests that qualified retirement plans are the absolute best way to save for retirement because these plans enable you to invest funds on a pre-tax basis during your peak earning years and the investment gains can grow tax-deferred until retirement when your income is lower.

This way of thinking makes a number of assumptions.

The first assumption is that the investments held within the qualified retirement plan will consistently grow in value and they will not experience any significant losses to principal at any time which would serve to stunt the plan’s growth.

The second assumption is that the individual is not capable of effectively using capital during his/her peak earning years to develop diversified income streams that would provide significant income during retirement years. Maybe this would better be stated as the assumption that there is actually a “peak earning period” in an individual’s life.

The third assumption is that the rules governing qualified retirement plans will never change. Mainstream personal finance assumes that the early-distribution penalty will always be 10% and the qualified distribution age will always be 59.5. Mainstream personal finance assumes that ‘ordinary’ tax rates will always be what they are currently. (We say that there is nothing ordinary about the income tax at all!)

What’s overlooked here is the fact that qualified retirement plans are a government-created solution to government-created problems: Onerous taxation and a constantly devalued dollar that make it very difficult for the average American to save for retirement.

Pay very close attention to the language that must be used to discuss qualified retirement plans. In talking about these plans one must use words like allow, may, require, and penalty. In other words, these plans consist of permissions and requirements. People are given permission by the government to contribute funds on a pre-tax basis. And they are given permission to defer taxes on their investments. But they are required to leave all funds in the account until they reach a certain age or they will be penalized.

Any time permission is required to do something it follows that the permission could also be withdrawn at some point in the future. Otherwise one would not need permission to do whatever it is.

If you recognize that qualified retirement plans are a government-created solution to a government-created problem then a very important question must be asked: What happens if the government decides that there are bigger problems than Americans saving too little?

For example, what if government’s biggest problem became the need to finance out of control spending?

Cyprus and Poland have provided two possible answers to that question and the trend suggests that the rules governing qualified retirement plans could very suddenly become less favorable for the individuals using them at some unknown point in the future. The “myRA” proposal seems to be the first step in this direction.

So we can’t help but be skeptical of qualified retirement accounts. It just doesn’t add up. IRS approved tax shelters as a government solution to taxation and inflation? It seems to us that cutting spending, cutting taxes, cutting inflation, and returning to sound money would be a much better solution.

So we will continue to stay away from qualified retirement plans in favor of the IBC strategy for maximizing capital. This strategy, if implemented correctly, does not expose our principal to loss, it offers us access to our capital at any time for any reason, and it offers favorable tax treatment as well. All without requiring us to adhere to silly IRS rules about what we can and cannot do with our money depending on how old we are.

It just makes more sense.

The Rule of Law

submitted by jwithrow.

The Rule of Law is rooted in British common law that dates back to the Middle Ages and it is the foundation of Western civilization. It is the underlying legal/ethical code of conduct that enabled western civilization to thrive.

The Rule of Law can be condensed into two fundamental laws:

1) Do all that you have agreed to do and nothing that you have agreed not to do.

2) Do not encroach upon other persons or their property.

The first law forms the basis of all contract law and the second law forms the basis of criminal law. These laws are simple and intuitive and history shows that a society dedicated to these laws is able to achieve prosperity.

Unfortunately, the Rule of Law has been subverted by the rule of legislation in our society today. There are now hundreds of thousands of petty laws on the books accompanied by millions of pages of legal mumbo-jumbo in supporting documents. Much of this legislation actually violates the Rule of Law as it encroaches upon personal liberty and property rights. Further, these petty laws are enforced at the discretion of the political class; politicians and insiders are largely exempt from abiding by their own legislation.

There was a time in America when grade schools taught common law and history lessons focused almost exclusively on common law principles. Sadly, this is no longer the case as the public educational system now teaches children to never question the validity of legal mandates and regulations, no matter how petty.

Fortunately, the Internet Reformation seems to be setting brushfires of liberty in the mind’s of men once again. These are certainly interesting times we are living in.

“The more corrupt the state, the more numerous the laws.” – Tacitus

“Where there are too many policemen, there is no liberty. Where there are too many soldiers, there is no peace. Where there are too many lawyers, there is no justice.” – Lin Yutang

“Good people do not need laws to tell them to act responsibly, while bad people will find a way around the laws” – Plato

Minimum Wage Cannot Fool the Free Market

submitted by jwithrow.

An important facet of a dynamic market economy is a flexible pricing system where prices can freely adjust in response to changes in supply and demand.

Wages are no exception to this rule. You see, wages are simply the price of labor and this price fluctuates with supply and demand in the marketplace – just like any other price.

When it comes to the jobs market, employers seek to hire employees at a wage which will allow the employer to profit on an employee’s labor. As such, the employee’s salary must necessarily be priced lower than the total value of his or her production. Otherwise the employer would not have a need for the employee’s services.

If this seems callous to you then please ask yourself a question:

Are you willing to pay someone $100 to do a job that is only worth $50 to you?

Well most employers aren’t either.

So, employers are willing to offer a salary within a specific value range according to the nature of the job function. The employee may be able to negotiate a higher salary but only up to the employer’s ceiling price beyond which the employer would not be able to justify the hire.

Minimum wage laws, however well-intentioned they may be, have no place within a free market system. Minimum wage laws distort the market pricing system and they fail to achieve their stated intent – they serve only to increase unemployment. Employers will trim their workforce to account for forced wage increases and individuals who would otherwise be willing to work for pay beneath the minimum wage will be priced out of employment.

What’s lost in the clamor for an increased minimum wage is the fact that wages are not the common man’s problem in the first place. U.S. median household income in 1970 was $7,651. It was $22,109 in 1985. And $41,262 in 2000. And median household income in 2012 was $50,099.

Wages have skyrocketed!

But wages don’t buy nearly as much as they used to, do they? Sounds to us like inflation is the common man’s biggest problem – let’s pass maximum inflation laws!

Or better yet, let’s End the Fed and get back to Sound Money.

The Beauty of Language

submitted by jwithrow.

Language is the means of communicating thoughts and ideas.

Thoughts and ideas have the power to shape the world.

Therefore, language has the power to shape the world.

Language is both powerful and beautiful; it is the means to meaning and truth. It is language that has changed the world over and over again. Without language, the Bible is meaningless. The Torah is meaningless. The Qur’an is meaningless. The Mahayana Sutras are meaningless. The Upanishads are meaningless. The Magna Carta is meaningless. The Declaration of Independence is meaningless.

Language is constructed of words and words are the expression of thoughts.

Thoughts are powerful entities; they are not abstractions. There is a very specific electrical reaction that takes place when you create a thought within your mind and this electrical reaction creates energy in some capacity. We cannot explain this electrical reaction as we do not know how it works. But we do know that it takes place. So it follows then that thoughts are energy in some capacity. And the laws of physics state that energy cannot be created nor destroyed rather it can only change forms. So it follows further then that the process of thinking is the process of transforming existing energy into your own unique thoughts. Your own unique thoughts become energy in a new form and the thought energy exists until it is transformed once again. And a powerful way to harness that thought energy is to convert it into language – either verbal or written.

We say all of that to say this: our observations suggest that language is used very carelessly in our culture today. If you understand the power of language then you understand the responsibility that you have to use words in a meaningful way. You understand that language should not be used to harm or mislead another. And you understand that language can be used to change your stars.

The most important language comes from that tiny voice in your head. Make sure that little voice in your head is constantly using language that uplifts and inspires you. Your world will also be uplifting and inspiring if it does.

It’s a funny thing; the events in your life mirror your thoughts. Master your thoughts and you will master your world. And in order to master your thoughts you have to master your control of language.

Sound Money

submitted by jwithrow.

The most important facet of free market capitalism is sound money. If you don’t have sound money then you don’t have free market capitalism – you have something else.

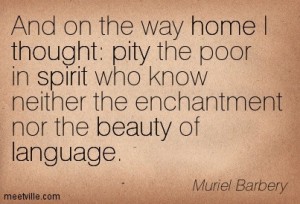

Sound money is simply money that serves as a reliable store of value. Put another way, sound money is money that does not constantly lose its purchasing power. Sound money affords one a reasonable expectation that one unit of money today will buy the same amount of goods and services as one unit of money tomorrow. And next month. And ten years from now.

What a novel concept!

Anyone who has taken a finance course is familiar with the time value of money principle. In finance class, we learn to discount our money over time based on the inflation rate. We are taught, correctly, that present dollars are worth more than future dollars.

What we are not taught is that this is a deformation of free market capitalism!

The general market has chosen gold and silver to serve as money throughout most of history because the precious metals are particularly well suited for this purpose: they are limited in supply, they have functional utility outside of the monetary system, and, unlike our money today, they cannot be created from nothing.

Make no mistake about it, that’s where our money comes from today: nothing. It is created from nothing and then loaned into existence at interest. See the Hidden Secrets of Money video series for a more thorough examination of our money.

You see, money should not be a function of government nor should it be a function of a central bank behind closed doors. And it certainly shouldn’t be created from nothing. This is why the U.S. Constitution only authorizes gold and silver as legal tender; the Founders knew well the virtues of sound money and the dangers of fiat currency.

Did you know that the U.S. dollar was defined by the Coinage Act of 1792 to be 371.25 grains of fine silver? This act set the standard weight and measure of the dollar in terms of silver and individuals in the market were still free to accept or reject coins of differing weights and measures as they saw fit.

But we digress.

Here is why sound money is important to you:

Every dollar to your name is constantly losing value and there is no way for you to predict how much value your savings will lose over time.

This is a direct result of the monetary system that is in place whereby central banks create money from nothing and then lend that money to governments and to commercial banks at interest. That money then enters the economy when governments spend it and when commercial banks lend it out to customers. This is done constantly and it is why your money constantly loses value. Such a system has a profound impact on people from every walk of life.

How can we accurately plan for anything long-term if our money is constantly losing value? We can only guess.

What we do know from history is that sound money leads to a stable economy while fiat money leads to booms and busts.

The general market prefers the former while big government prefers the latter.

For more information on the sound money principle see the article links below. For a lot more information on sound money and monetary history see the book links below.

An Introduction to Sound Money

The Case for Gold and Silver Bullion

submitted by jwithrow.

While gold and silver prices have declined in 2013, the fundamental case for owning gold and silver bullion is still growing.

The mainstream media has been quick to pronounce the death of the precious metals as an asset class with their evidence being the recent price depreciation of both gold and silver. Theirs is a very short term and self-serving view; the long term fundamentals have not changed.

The Federal Reserve did taper its money printing, but guess what? The creature from Jekyll Island is still creating $75 billion new dollars every single month to purchase U.S. Treasury bonds and mortgage backed securities. Meanwhile, Congress has quietly done away with the sequester spending ‘cuts’ and will continue to spend gargantuan amounts of money in 2014 – money they do not have.

What’s so humorous about this is the fact that the sequester did not cut any real spending in the first place – it simply curtailed proposed future spending increases. We suppose the thought of curtailed spending increases kept the Congress critters up too late at night.

And it’s not just the U.S.

Japan has promised to continue to keep their central bank money printer on turbo gear. Estimates suggest that the U.S. and Japan together will create nearly $2 trillion over the next 12 month period. Meanwhile, the Eurozone experiment is still on the verge of blowing up and not one single G-20 country operates with a balanced budget.

Simply put, the economies of the developed world have run up massive amounts of debt that cannot possibly be paid back in full. The massive debt has been serviced primarily by central bank funny money up to this point, but we are quite sure that the funny money policies cannot possibly last forever. And the longer the printing presses continue to run, the less valuable our paper currencies will be.

That’s why we adamantly believe that gold and silver bullion will be a vital part of a diversified portfolio in the coming years as the economic endgame of central bank funny money policy plays out.

Now, we don’t think it would be prudent to hold 100% of one’s assets in gold and silver. We look at the precious metals more as insurance against destructive monetary policies. Oh, and we should probably clarify that we mean physical gold and silver bullion in your possession, not an ETF.

So if you expect the value of your paper currency to increase then you may not be interested in holding gold or silver bullion. But if you expect the value of your paper currency to decrease then purchasing gold and silver bullion may be very wise. Given the long term fundamentals, we would suggest that the value of our paper currency is ultimately only going to go in one direction.

And that direction is back to paper currency’s inherent value…

The Lesson From Monopoly

submitted by jwithrow.

Chances are you have played the once popular board game Monopoly. In the event that you have never played the game then I would highly recommend it to you as there is a valuable lesson to be learned. And it is a classic!

The object of the game is to buy up as much real estate as possible so you can earn rental income when another player ‘lands’ on your real estate. Once you have acquired the real estate then you can invest in houses and hotels to increase your rental income.

Common thinking suggests that the game is called Monopoly because players attempt to achieve a real estate monopoly.

I do not think this is accurate, however. I would suggest that the title is derived from the fact that the ‘bank’ holds a monopoly on the money supply.

The object of the game is not to hoard the Monopoly money but rather to convert the money into productive assets. These productive assets then generate additional money in the form of rental income which can be used to subsequently purchase more productive assets when the opportunity arises.

Interestingly, the money generated from productive assets can also be used to pay taxes when the player is unfortunate enough to ‘land’ on those spots.

Players of the game understand that the Monopoly money holds no inherent value. The Monopoly money is only the accepted means of exchange with which productive assets can be purchased.

This is the lesson that we would be wise to learn and apply.

The Monopoly money is not terribly different from our fiat currency today. Our currency holds no inherent value and the central bank (Federal Reserve) holds a monopoly on the money supply. In fact, the Monopoly money may actually be better in context than our dollar because the Monopoly money maintains its value over the course of the game whereas our dollar is constantly losing value due to inflation.

So in this regard, the key to our own personal financial success is not terribly different from the object of Monopoly. The path to true wealth in life is the same as it is in the game – use the monopoly money to purchase income-generating assets. Obviously this is more complex in real life as there are a myriad of assets of varying quality to choose from and the process of acquiring these assets is much more complicated than ‘landing’ on their spot. But the concept remains the same.

Mainstream personal finance does a poor job of emphasizing this. Personal finance gurus almost exclusively suggest that we invest all of our surplus money in stocks and bonds employing a “buy, hold, and pray” strategy. This may be due to the fact that financial advisors make their living by selling the securities they tout. And while there may be a place in our investment portfolio for paper securities, they certainly do not take the place of real productive assets and one would be wise to understand the nature of the markets and the business cycle before jumping in.

Keep this concept well in mind as you build and execute your own personal financial plan. The goal is not to end up with the most money at the end of the day; it is to use money to acquire productive assets that will then provide income streams. It is essential to also employ an asset allocation model so that you are diversified across several different asset classes.

Always remember that money is just an illusion. Its only purpose is to serve as a medium of exchange and a temporary store of value. It is wise to keep a healthy amount of cash on hand at all times for both opportunities and emergencies, but any cash above your allocation would best serve you in other asset classes.

**Want more information on how to implement the lesson from Monopoly and build a sustainable asset allocation model? Are you ready to turbo-charge your retirement portfolio? Do you yearn to exit the rat-race? Is financial freedom calling to your spirit?

Do not take a backseat when it comes to your own finances. Learn everything you need to know to master your finances in 30 days by enrolling in Finance for Freedom today!

Money is an Illusion

submitted by jwithrow.

Currently we use fiat currency as money… But it’s just an illusion.

If you doubt this then ask yourself the question: What is money?

Yes, you know what money does – it buys things. But what is it?

Is it a green piece of paper with numbers and words and some symbols printed on it? Is it a card with your name, a string of numbers, and a bank logo on it?

Or is that just a piece of paper and a piece of plastic?

Fiat money is not wealth. That runs contrary to everything our society has told us, but it is the truth.

Fiat money is simply a medium of exchange which can then be used to acquire wealth… But the money itself is nothing more than a tool.

Historically, we have used gold and silver, and notes backed by gold and silver as money.

Our fiat currencies today serve the same purpose as gold and silver money… But there is one major difference. Fiat currencies can be created arbitrarily from nothing. And the central banks of the world create their fiat currencies out of thin air in massive numbers.

That’s the biggest secret of the 1% – fiat money is an illusion that is available in abundance.

While fiat money can be created out of thin air, the value of existing money necessarily falls as new money enters the economy. That’s just basic supply and demand economics. All things equal, value goes down as supply goes up.

Basically, the new money steals value from the old money. The old money can buy less and less over time. It loses purchasing power.

And that means they poach value from your bank account every time they pump a little more money into the system.

As a result, our cost of living rises over time.

Because of that, the key to financial success is not to hoard money. It’s to use money to acquire assets… Assets that rise in value over time because of all the new money being created from nothing.

The truth is, money is little more than an idea. It is an illusion… And it is only valuable as long as it is perceived to be valuable.

So if you think of money as an idea and not as a tangible asset, you will see that it takes nothing but an idea to obtain more money. But that money must then be exchanged for assets in order for it to be converted into wealth.

P.S. My Finance for Freedom course series pulls back the curtain on how money and finance really work. And it covers expert financial strategies to increase income, build wealth, and shatter the glass ceiling forever. Learn more at newly revamped https://financeforfreedomcourse.com/.

Nominal Income vs. Real Income

submitted by jwithrow.

Most of us understand that inflation is a given in our world today… But not too many of us think about how inflation affects our income.

We tend to think of our income in nominal terms rather than in real terms because that’s what we can see. We can see the numbers. After all, nominal income is our income defined only by its dollar amount.

While this just seems like common sense, it’s not the real story. You can expose the flaw of nominal income when you compare it over periods of time.

Think about this. What if our income goes from $48,000 last year to $50,000 this year? That’s a 4% raise. Not too bad, right?

Well, let’s look at our income in real terms. Real income is income defined by its purchasing power. It is nominal income adjusted for inflation.

What if inflation rises to 4% this year?

Well, the means our $50,000 salary this year will have basically the same purchasing power as our $48,000 salary last year. In other words, we didn’t get ahead. Our raise wasn’t actually raise. That’s because our income did not go up in real terms… even though our paychecks were bigger.

That’s why it’s so important to see income in terms of purchasing power… Not in terms of nominal dollars.

The real story is that the American middle class has been stuck on a giant hamster wheel for decades now. Their paychecks keep getting bigger… But their purchasing power is destroyed by inflation. They are stuck.

This is why the Austrian School of Economics views inflation as an insidious tax. If nominal income kept pace with inflation then it would not be so bad. But wages have struggled to keep up with inflation since the early 70s.

Now, wages have done a decent job of keeping up with the Consumer Price Index (CPI). But this index has been adjusted several times to ignore food and fuel price increases. They fudge the numbers to make the CPI look better.

By the way, Social Security promises cost of living increases tied to the CPI… Retirees are getting a raw deal there.

This concept also exposes the retirement folly pushed by the financial services industry.

Have you seen those commercials about your “magic number”? They say you need a certain amount of dollars saved up for retirement to live securely off the income.

But if you think in terms of real income and purchasing power… It is impossible to pinpoint a magic number. Inflation will constantly eat into it. That’s why their magic number is just a carrot on a string.

So, the only way to truly take control of your own financial destiny is to think in real terms… And to recognize the nominal view of money for the illusion that it is.

P.S. Our Finance for Freedom course series pulls back the curtain on how money and finance really work. And it covers expert financial strategies to increase income, build wealth, and shatter the glass ceiling forever. Learn more at newly revamped https://financeforfreedomcourse.com/.