by Justin Spittler – Hard Assets Alliance :

Investors are finally coming to their senses. With the return of volatility, the complacency of the financial markets towards to the problems facing the global economy is now fracturing. That’s music to the ears of precious metals investors. And it’s a big reason gold started 2015 so hot.

Turmoil in Europe, in particular, has become too much to ignore. However, following the announcement by the Swiss National Bank (SNB) to sever the franc’s peg to the euro and the landmark decision by the ECB to finally import quantitative easing (QE), investors are wondering where gold’s next push will come from.

Catalysts Outnumber Threats

Volatility is back. That’s bad news for most asset classes, yet positive for precious metals. Gold, in particular, shines brightest when fear trumps greed, and right now there are numerous forces conspiring to drive gold higher.

For starters, Europe is still very much a basket case. Relations between Ukraine and Russia remain tense, and the prospect of a “Grexit” looms large. There’s also a good chance that Draghi ups the ante on QE. Few analysts think that the €1.1 trillion bond-buying program will be enough to rejuvenate the continent’s much maligned economy.

A challenged eurozone isn’t the only probable catalyst for gold. The unexpected drop in energy prices could be foreshadowing a global economic slowdown. It also threatens to derail a US recovery that has leaned heavily on a domestic energy revolution, especially if prices stay low for long. JPMorgan estimates that three years of oil at $65 per barrel would lead to a 25% to 40% default rate across the US energy junk bond market.

Time will also reveal how resilient the US stock market rally is now that the Fed has removed the punch bowl. Let’s also not forget about China’s cooling economy. Same goes for continued bullion hoarding by central banks, increasing calls for repatriation, or a potential collapse of the Russian debt market, and that’s just on the demand side.

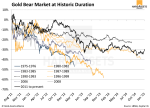

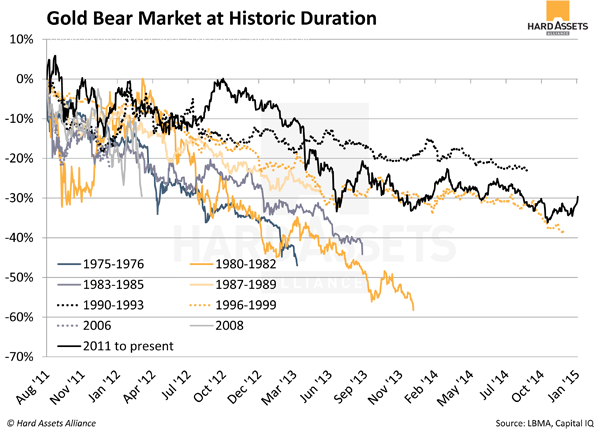

After registering all-time highs in 2011, gold dropped below $1,200 per ounce, or below the industry all-in sustaining cost of production. While total mine output inched higher during this weak price environment, nonferrous exploration budgets declined 45% between 2012 and 2014, according to metals consultancy group SNL.

Depressed prices have been especially unforgiving to junior miners, who play a key role in the global supply chain by venturing into uncharted territories in search of the next big deposit.

Total exploration budgets for junior miners fell 29% in 2014 after sliding 39% year over year in 2013 due to skittish investor interest.

Not even a dramatic price rally can undo years of greatly reduced exploration activity. In other words, the seeds of a supply crunch have been sowed.

Long Term Case for Gold Strengthens

There’s no guarantee that gold will maintain its momentum over the rest of the year but the scales are certainly tipped in its favor. Even commonly cited headwinds support the argument for owning gold over the long haul.

Consider the prospect of rising interest rates in the United States. Higher rates effectively increase the cost of owning gold, which pays no yield. Point taken, but a modest rate increase for bonds paying next to nothing isn’t going to make owning gold that much more expensive.

Further, Yellen will likely be extra patient with regard to raising rates. The Fed hasn’t lifted rates in nine years and doing so now would likely send the precarious recovery into a tailspin.

Sleep Easier With Precious Metals

If the first few weeks of 2015 are any indication, this will be an eventful year.

Global uncertainty has many investors on edge, but one can sleep easier with an appropriate allocation to precious metals. Just remember that today’s bargain prices won’t last forever.

Article originally posted in the February issue of Smart Metals Investor at HardAssetsAlliance.com.