submitted by jwithrow.

Tag: fiat currency

Acquire Assets

submitted by jwithrow.

Wealth comes as a result of the acquisition of assets. If you want to be wealthy you must do two things:

- Acquire assets

- Avoid liabilities

Sounds easy, right?

Well let’s make sure that we understand the difference between an asset and a liability.

Robert Kiyosaki offers a solid fundamental distinction:

“An asset is something that puts money into my pocket. A liability is something that takes money out of my pocket.”

We would expand upon this distinction by stating:

- An asset is something that will maintain or increase in value over time.

- A liability is something that will decline in value over time.

With this understanding (sans-accounting), we can think of two big liabilities that far too many people acquire thinking that they are assets:

1: Cars

Cars, no matter how luxurious, will lose value over time.

In addition to losing value, cars also carry acquisition and repair costs. When the acquisition costs involve taking on additional debt then the purchase of a car is even more financially damaging.

We prefer to drive a beater until the wheels fall off.

If you must have a nice car, follow Mr. Kiyosaki’s advice and first acquire a productive asset that will provide the cash flow to pay for the car.

2: Currency (fiat money)

Yes, those lovely U.S. dollars sitting in your bank account are actually liabilities.

Preposterous, you say?

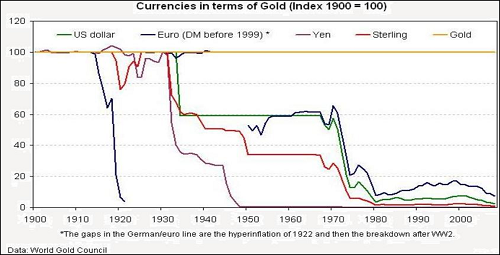

Please search the internet for a chart of the U.S. dollar’s value over time and see for yourself.

Or just read our essay on sound money.

The U.S. dollar has lost 98% of its value since 1913 and this trend will continue.

The solution is to trade dollars for assets – do this sooner rather than later while folks still think dollars are valuable.

Investing in Gold and Silver Bullion

submitted by jwithrow.

Investing in gold and silver bullion is, believe it or not, much easier than investing in stocks, mutual funds, exchange-traded funds, or bonds.

If the concept of investing in gold and silver seems strange to you, it is only because the financial media has marginalized the precious metals in order to sell more paper equities and the mainstream media has associated the precious metals with paranoid dooms-dayers. And apparently you haven’t been reading our little blog here.

You see, gold is money. It has been for all of recorded history.

You can’t pay your taxes with gold because your government knows that no one would want government currency if you could. And then your government would be in big trouble.

We talk about the ‘why’ in more detail here and here so now let’s look at the ‘how’.

Gold and silver bullion is available in the form of coins and bars of varying weights and measures and purchases can be made either in person at a reputable coin dealer or online through an internet dealer.

The advantage of buying from a local coin dealer is that you can pay in cash anonymously and you can potentially develop a working relationship with the dealer. The downside is that you will have to pay your state sales tax on all bullion purchases made at a local dealer.

The advantage of buying online is that you don’t have to leave your home and you can avoid the state sales tax (for the time being, anyway). The downside is that you cannot purchase anonymously and there is a delay between purchase and delivery.

Gold and silver bullion can also be sold back to the same dealers – be sure to research their individual policy.

The IRS currently classifies precious metal bullion as a collectible and thus taxes the gain on sale at the collectible rate which is 28%. Keep this in mind if you choose to invest in gold and silver bullion, especially if you sacrifice anonymity and purchase online. Also, be sure to stay updated on the current tax laws regarding gold and silver bullion as they could change at any given time.

There are many strategies when it comes to investing in gold and silver but a general rule of thumb is to stay away from unique collectibles (numismatics) unless you are very knowledgeable in the field. The reason being is that numismatics carry a much higher premium than standard bullion from well-known mints but there is a much smaller market for these rare coins and thus they are much less liquid.

Our favorite strategy is to dollar-cost-average into both gold and silver periodically at the ratio of one American Gold Eagle to twenty American Silver Eagles.

Hidden Secrets of Money Primer Part 2

submitted by jwithrow.

Sound Money

submitted by jwithrow.

The most important facet of free market capitalism is sound money. If you don’t have sound money then you don’t have free market capitalism – you have something else.

Sound money is simply money that serves as a reliable store of value. Put another way, sound money is money that does not constantly lose its purchasing power. Sound money affords one a reasonable expectation that one unit of money today will buy the same amount of goods and services as one unit of money tomorrow. And next month. And ten years from now.

What a novel concept!

Anyone who has taken a finance course is familiar with the time value of money principle. In finance class, we learn to discount our money over time based on the inflation rate. We are taught, correctly, that present dollars are worth more than future dollars.

What we are not taught is that this is a deformation of free market capitalism!

The general market has chosen gold and silver to serve as money throughout most of history because the precious metals are particularly well suited for this purpose: they are limited in supply, they have functional utility outside of the monetary system, and, unlike our money today, they cannot be created from nothing.

Make no mistake about it, that’s where our money comes from today: nothing. It is created from nothing and then loaned into existence at interest. See the Hidden Secrets of Money video series for a more thorough examination of our money.

You see, money should not be a function of government nor should it be a function of a central bank behind closed doors. And it certainly shouldn’t be created from nothing. This is why the U.S. Constitution only authorizes gold and silver as legal tender; the Founders knew well the virtues of sound money and the dangers of fiat currency.

Did you know that the U.S. dollar was defined by the Coinage Act of 1792 to be 371.25 grains of fine silver? This act set the standard weight and measure of the dollar in terms of silver and individuals in the market were still free to accept or reject coins of differing weights and measures as they saw fit.

But we digress.

Here is why sound money is important to you:

Every dollar to your name is constantly losing value and there is no way for you to predict how much value your savings will lose over time.

This is a direct result of the monetary system that is in place whereby central banks create money from nothing and then lend that money to governments and to commercial banks at interest. That money then enters the economy when governments spend it and when commercial banks lend it out to customers. This is done constantly and it is why your money constantly loses value. Such a system has a profound impact on people from every walk of life.

How can we accurately plan for anything long-term if our money is constantly losing value? We can only guess.

What we do know from history is that sound money leads to a stable economy while fiat money leads to booms and busts.

The general market prefers the former while big government prefers the latter.

For more information on the sound money principle see the article links below. For a lot more information on sound money and monetary history see the book links below.

An Introduction to Sound Money

The Lesson From Monopoly

submitted by jwithrow.

Chances are you have played the once popular board game Monopoly. In the event that you have never played the game then I would highly recommend it to you as there is a valuable lesson to be learned. And it is a classic!

The object of the game is to buy up as much real estate as possible so you can earn rental income when another player ‘lands’ on your real estate. Once you have acquired the real estate then you can invest in houses and hotels to increase your rental income.

Common thinking suggests that the game is called Monopoly because players attempt to achieve a real estate monopoly.

I do not think this is accurate, however. I would suggest that the title is derived from the fact that the ‘bank’ holds a monopoly on the money supply.

The object of the game is not to hoard the Monopoly money but rather to convert the money into productive assets. These productive assets then generate additional money in the form of rental income which can be used to subsequently purchase more productive assets when the opportunity arises.

Interestingly, the money generated from productive assets can also be used to pay taxes when the player is unfortunate enough to ‘land’ on those spots.

Players of the game understand that the Monopoly money holds no inherent value. The Monopoly money is only the accepted means of exchange with which productive assets can be purchased.

This is the lesson that we would be wise to learn and apply.

The Monopoly money is not terribly different from our fiat currency today. Our currency holds no inherent value and the central bank (Federal Reserve) holds a monopoly on the money supply. In fact, the Monopoly money may actually be better in context than our dollar because the Monopoly money maintains its value over the course of the game whereas our dollar is constantly losing value due to inflation.

So in this regard, the key to our own personal financial success is not terribly different from the object of Monopoly. The path to true wealth in life is the same as it is in the game – use the monopoly money to purchase income-generating assets. Obviously this is more complex in real life as there are a myriad of assets of varying quality to choose from and the process of acquiring these assets is much more complicated than ‘landing’ on their spot. But the concept remains the same.

Mainstream personal finance does a poor job of emphasizing this. Personal finance gurus almost exclusively suggest that we invest all of our surplus money in stocks and bonds employing a “buy, hold, and pray” strategy. This may be due to the fact that financial advisors make their living by selling the securities they tout. And while there may be a place in our investment portfolio for paper securities, they certainly do not take the place of real productive assets and one would be wise to understand the nature of the markets and the business cycle before jumping in.

Keep this concept well in mind as you build and execute your own personal financial plan. The goal is not to end up with the most money at the end of the day; it is to use money to acquire productive assets that will then provide income streams. It is essential to also employ an asset allocation model so that you are diversified across several different asset classes.

Always remember that money is just an illusion. Its only purpose is to serve as a medium of exchange and a temporary store of value. It is wise to keep a healthy amount of cash on hand at all times for both opportunities and emergencies, but any cash above your allocation would best serve you in other asset classes.

**Want more information on how to implement the lesson from Monopoly and build a sustainable asset allocation model? Are you ready to turbo-charge your retirement portfolio? Do you yearn to exit the rat-race? Is financial freedom calling to your spirit?

Do not take a backseat when it comes to your own finances. Learn everything you need to know to master your finances in 30 days by enrolling in Finance for Freedom today!

Money is an Illusion

submitted by jwithrow.

Currently we use fiat currency as money… But it’s just an illusion.

If you doubt this then ask yourself the question: What is money?

Yes, you know what money does – it buys things. But what is it?

Is it a green piece of paper with numbers and words and some symbols printed on it? Is it a card with your name, a string of numbers, and a bank logo on it?

Or is that just a piece of paper and a piece of plastic?

Fiat money is not wealth. That runs contrary to everything our society has told us, but it is the truth.

Fiat money is simply a medium of exchange which can then be used to acquire wealth… But the money itself is nothing more than a tool.

Historically, we have used gold and silver, and notes backed by gold and silver as money.

Our fiat currencies today serve the same purpose as gold and silver money… But there is one major difference. Fiat currencies can be created arbitrarily from nothing. And the central banks of the world create their fiat currencies out of thin air in massive numbers.

That’s the biggest secret of the 1% – fiat money is an illusion that is available in abundance.

While fiat money can be created out of thin air, the value of existing money necessarily falls as new money enters the economy. That’s just basic supply and demand economics. All things equal, value goes down as supply goes up.

Basically, the new money steals value from the old money. The old money can buy less and less over time. It loses purchasing power.

And that means they poach value from your bank account every time they pump a little more money into the system.

As a result, our cost of living rises over time.

Because of that, the key to financial success is not to hoard money. It’s to use money to acquire assets… Assets that rise in value over time because of all the new money being created from nothing.

The truth is, money is little more than an idea. It is an illusion… And it is only valuable as long as it is perceived to be valuable.

So if you think of money as an idea and not as a tangible asset, you will see that it takes nothing but an idea to obtain more money. But that money must then be exchanged for assets in order for it to be converted into wealth.

P.S. My Finance for Freedom course series pulls back the curtain on how money and finance really work. And it covers expert financial strategies to increase income, build wealth, and shatter the glass ceiling forever. Learn more at newly revamped https://financeforfreedomcourse.com/.

Nominal Income vs. Real Income

submitted by jwithrow.

Most of us understand that inflation is a given in our world today… But not too many of us think about how inflation affects our income.

We tend to think of our income in nominal terms rather than in real terms because that’s what we can see. We can see the numbers. After all, nominal income is our income defined only by its dollar amount.

While this just seems like common sense, it’s not the real story. You can expose the flaw of nominal income when you compare it over periods of time.

Think about this. What if our income goes from $48,000 last year to $50,000 this year? That’s a 4% raise. Not too bad, right?

Well, let’s look at our income in real terms. Real income is income defined by its purchasing power. It is nominal income adjusted for inflation.

What if inflation rises to 4% this year?

Well, the means our $50,000 salary this year will have basically the same purchasing power as our $48,000 salary last year. In other words, we didn’t get ahead. Our raise wasn’t actually raise. That’s because our income did not go up in real terms… even though our paychecks were bigger.

That’s why it’s so important to see income in terms of purchasing power… Not in terms of nominal dollars.

The real story is that the American middle class has been stuck on a giant hamster wheel for decades now. Their paychecks keep getting bigger… But their purchasing power is destroyed by inflation. They are stuck.

This is why the Austrian School of Economics views inflation as an insidious tax. If nominal income kept pace with inflation then it would not be so bad. But wages have struggled to keep up with inflation since the early 70s.

Now, wages have done a decent job of keeping up with the Consumer Price Index (CPI). But this index has been adjusted several times to ignore food and fuel price increases. They fudge the numbers to make the CPI look better.

By the way, Social Security promises cost of living increases tied to the CPI… Retirees are getting a raw deal there.

This concept also exposes the retirement folly pushed by the financial services industry.

Have you seen those commercials about your “magic number”? They say you need a certain amount of dollars saved up for retirement to live securely off the income.

But if you think in terms of real income and purchasing power… It is impossible to pinpoint a magic number. Inflation will constantly eat into it. That’s why their magic number is just a carrot on a string.

So, the only way to truly take control of your own financial destiny is to think in real terms… And to recognize the nominal view of money for the illusion that it is.

P.S. Our Finance for Freedom course series pulls back the curtain on how money and finance really work. And it covers expert financial strategies to increase income, build wealth, and shatter the glass ceiling forever. Learn more at newly revamped https://financeforfreedomcourse.com/.