by the Hard Assets Alliance Team:

Quantitative easing is coming to Europe. Will Draghi’s massive bond-buying program be enough to get the European economy on track? The Hard Assets Alliance team doubts it, but we are expecting European equities to rally just as US and Japanese stocks did after their central banks unleashed similar asset-purchasing schemes.

One way quantitative easing supports stock market rallies is by suppressing rates. Companies then use this cheap credit to build new factories and purchase new equipment, right? Not quite.

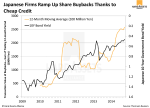

In the United States and Japan, firms have been reluctant to make capital investments due to lingering uncertainty. Instead, they have taken advantage of rock-bottom rates to buy back shares. Just look at what happened in Japan once rates started heading south:

There is nothing inherently wrong with stock buybacks. They are shareholder friendly, low risk, and effective at boosting stock prices. Share repurchases are also more flexible than dividends—the market punishes companies that suspend or reduce dividend payments.

However, by not building factories or purchasing new equipment, companies are tacitly expressing concern about the future. It’s important to understand this because share buybacks shrink share count and thereby juice the earnings per share (EPS) figure, making a company look more profitable.

QE is slated to have the same impact on European stocks, and that means a near-term investment opportunity. However, it’s also a reminder that market intervention is the only game in town these days. Sooner or later, the efficacy of these policies will wear off. When that occurs, you will surely want to own precious metals.

Article originally posted in the February issue of Smart Metals Investor at HardAssetsAlliance.com.