submitted by jwithrow.

The most important facet of free market capitalism is sound money. If you don’t have sound money then you don’t have free market capitalism – you have something else.

Sound money is simply money that serves as a reliable store of value. Put another way, sound money is money that does not constantly lose its purchasing power. Sound money affords one a reasonable expectation that one unit of money today will buy the same amount of goods and services as one unit of money tomorrow. And next month. And ten years from now.

What a novel concept!

Anyone who has taken a finance course is familiar with the time value of money principle. In finance class, we learn to discount our money over time based on the inflation rate. We are taught, correctly, that present dollars are worth more than future dollars.

What we are not taught is that this is a deformation of free market capitalism!

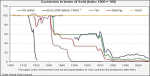

The general market has chosen gold and silver to serve as money throughout most of history because the precious metals are particularly well suited for this purpose: they are limited in supply, they have functional utility outside of the monetary system, and, unlike our money today, they cannot be created from nothing.

Make no mistake about it, that’s where our money comes from today: nothing. It is created from nothing and then loaned into existence at interest. See the Hidden Secrets of Money video series for a more thorough examination of our money.

You see, money should not be a function of government nor should it be a function of a central bank behind closed doors. And it certainly shouldn’t be created from nothing. This is why the U.S. Constitution only authorizes gold and silver as legal tender; the Founders knew well the virtues of sound money and the dangers of fiat currency.

Did you know that the U.S. dollar was defined by the Coinage Act of 1792 to be 371.25 grains of fine silver? This act set the standard weight and measure of the dollar in terms of silver and individuals in the market were still free to accept or reject coins of differing weights and measures as they saw fit.

But we digress.

Here is why sound money is important to you:

Every dollar to your name is constantly losing value and there is no way for you to predict how much value your savings will lose over time.

This is a direct result of the monetary system that is in place whereby central banks create money from nothing and then lend that money to governments and to commercial banks at interest. That money then enters the economy when governments spend it and when commercial banks lend it out to customers. This is done constantly and it is why your money constantly loses value. Such a system has a profound impact on people from every walk of life.

How can we accurately plan for anything long-term if our money is constantly losing value? We can only guess.

What we do know from history is that sound money leads to a stable economy while fiat money leads to booms and busts.

The general market prefers the former while big government prefers the latter.

For more information on the sound money principle see the article links below. For a lot more information on sound money and monetary history see the book links below.

An Introduction to Sound Money