submitted by jwithrow.

An important facet of a dynamic market economy is a flexible pricing system where prices can freely adjust in response to changes in supply and demand.

Wages are no exception to this rule. You see, wages are simply the price of labor and this price fluctuates with supply and demand in the marketplace – just like any other price.

When it comes to the jobs market, employers seek to hire employees at a wage which will allow the employer to profit on an employee’s labor. As such, the employee’s salary must necessarily be priced lower than the total value of his or her production. Otherwise the employer would not have a need for the employee’s services.

If this seems callous to you then please ask yourself a question:

Are you willing to pay someone $100 to do a job that is only worth $50 to you?

Well most employers aren’t either.

So, employers are willing to offer a salary within a specific value range according to the nature of the job function. The employee may be able to negotiate a higher salary but only up to the employer’s ceiling price beyond which the employer would not be able to justify the hire.

Minimum wage laws, however well-intentioned they may be, have no place within a free market system. Minimum wage laws distort the market pricing system and they fail to achieve their stated intent – they serve only to increase unemployment. Employers will trim their workforce to account for forced wage increases and individuals who would otherwise be willing to work for pay beneath the minimum wage will be priced out of employment.

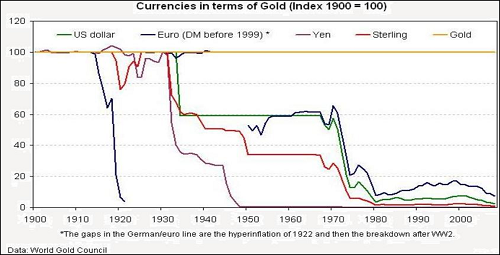

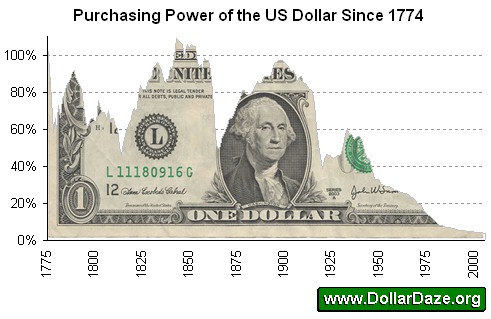

What’s lost in the clamor for an increased minimum wage is the fact that wages are not the common man’s problem in the first place. U.S. median household income in 1970 was $7,651. It was $22,109 in 1985. And $41,262 in 2000. And median household income in 2012 was $50,099.

Wages have skyrocketed!

But wages don’t buy nearly as much as they used to, do they? Sounds to us like inflation is the common man’s biggest problem – let’s pass maximum inflation laws!

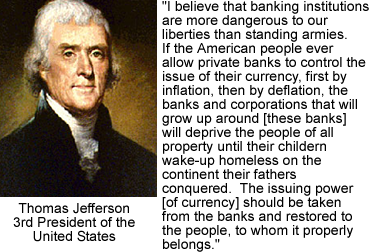

Or better yet, let’s End the Fed and get back to Sound Money.