by Andrea Candee – ICPA.org:

“Self empowerment” is the buzz word of our time. Yet, many feel disempowered when it comes to the care of their family’s health. Integrated medicine, taking the best of all worlds, is a sensible, responsible approach to healthcare. Here’s more from Andrea Candee, author of Gentle Healing for Baby and Child.

Trying Herbs

Grandparents recognize this as the health care approach of their youth: administer natural remedies at home unless the situation requires more professional help. Perhaps this is why grandparents seem to be the biggest purchasers of books on natural wellness for children, offering it to their adult children for the care of the grandchildren.

Turning to the health food store or even the kitchen pantry, and given a medical diagnosis, a parent educated in medicinal herbs can return a youngster to health or soothe discomfort until seen by the family care provider. And what better way to empower a child about their own wellness than to engage them in their healthcare, creating an awareness that will stay with them for their entire lives. They learn that taking care of their bodies preventatively is every bit as important as consulting a doctor when they are sick.

Statistics indicate that 75 percent of children have at least three ear infections before the age of six. Most of us either have or know a child who repeatedly suffers from what we have tacitly come to accept as a common childhood illness. Doesn’t it make you wonder why, with all the advances of modern medicine, children seem to suffer from ear infections more, rather than less than they did even 20 years ago?

Some children respond well to antibiotics; others are put on a round robin of antibiotic treatments (sometimes for years); and others still require surgery. A study reported in The Journal of the American Medical Association found that children given antibiotics for ear infections were two to six times more likely to develop a recurrence than children who did not receive the antibiotic treatment.

I am not the only one asking the question: What long-term effects do antibiotics have on developing immune systems?

“We found that, in the case of ear infections, sometimes the prescribed medicines created other problems and occasionally didn’t even cure…We have had the opportunity…to observe how effective, gentle and well tolerated these (herbal) remedies are in children.” (Larry Baskind, MD, FAAP, Riverside Pediatrics, Croton on Hudson, NY; excerpted from the foreword of Gentle Healing for Baby and Child [Simon & Schuster] ).

First Signs of Ear Discomfort

I recommend the following courses of action at the earliest signs of ear discomfort:

• Limit the intake of sugar. Processed sugar is a challenge to the body and feeds fungal, parasitic, and bacterial infections. Reduce fruit juice intake by diluting with water. Learn how to use echinacea, an invaluable immune system support found in health food stores, at the first sign of infection. Colds usually wind up in the ears of children predisposed to weakness in this part of their body. If you can prevent a cold from blossoming, you will have prevented another ear infection from developing.

• If a cold does take hold, you may choose to introduce an herbal decongestant.

• Add garlic to your child’s diet. Garlic is naturally anti-bacterial, as well as anti-fungal, anti-viral, and anti-parasitic. A fresh clove can be chopped into mashed potatoes or put on toast with butter.

• If infected fluid has settled in the ear, and there is no perforation of the eardrum (check with your family practitioner to be sure of this) add a drop or two of anti-microbial garlic oil in each ear, along with a drop or two oil of mullein flower. Mullein flower is well known for its anti-inflammatory, decongestant action in the ear. The easiest time to administer ear drops is when a child is sleeping.

• If there is pain in the ear, add a drop or two of St. John’s Wort oil. Its ability to calm nerve sensitivity may help to diminish the discomfort.

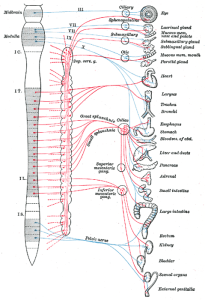

• For many children, chiropractic adjustments have been instrumental in preventing recurrent ear infections. If there is a misalignment in the spine affecting nerve and muscle function, chiropractic adjustments could help by enhancing proper drainage and function.

Don’t be afraid to implement all of the above protocols even if your child is on an antibiotic (To maintain the integrity of the intestinal tract, if your child is ever on an antibiotic, be sure to provide your child with a good source of probiotics). When a parent is informed and courageous enough to take charge of the situation, I have seen even the most chronic ear infections turned around—indeed eliminated—from the child’s life.

View article references and author information here:

www.pathwaystofamilywellness.org/references.html

Ear Infections

Van D. Merkle, DC Says:

1. Become informed about Prevnar vaccine (PCV7), also known as the pneumococcal strep vaccine, or ear-ache vaccine. The literature does not support its use.

2. Avoid ALL dairy products, sugar, and congestive type foods.

3. Try Monolaurin, an immune system enhancer.

4. Echinacea: 3/day. For infants 4 months to 25 lbs use 1 echinacea per day; open the capsule and put in food or water.

5. Chiropractic adjustments have been shown to be of great benefit.

Management of Acute Otitis Media Summary

1. Nearly two thirds of children with uncomplicated ear infections recover from pain and fever within 24 hours of diagnosis without antibiotic treatment. Over 80% recover within 1 to 7 days.

2. More than 5 million cases of acute ear infections occur annually, costing about $3 billion.

3. The report points out that in other countries otitis media is not always treated with drugs at the first sign of infection. Rather, in children over the age of 2 years, the norm is to watch and see how the infection progresses over the course of a few days.

4. The report notes that in the Netherlands the rate of bacterial resistance is about 1%, compared with the US average of around 25%. 1

What Causes Damage to the Ear and/or Ear Infection?

Ear Wax: “During more than 25 years in pediatric medicine, I have never seen a case of permanent hearing loss as a result of ear infection…Parents and doctors can be responsible for injury to the ear canal and the eardrum because of the efforts to remove wax from the ear. It is inadvisable for you or your doctor to use ANY kind of instrument to remove wax forcibly from your child’s ears, even a cotton swab.” – Robert S. Mendelsohn, MD

The best was to remove ear wax is by inserting a few drops of hydrogen peroxide into the ear twice a day for 2 or 3 days. Let the peroxide remain in the ear for several minutes and then rinse the ear with gentle bursts of water from a syringe.

Pacifiers: Pacifier use was found to cause a 40% increased risk of ear infections in infants, as well as higher rates of tooth decay and thrush, according to Dr. Marjo Niemela and associates from the University of Oulu in Finland. Pediatrics September, 2000;106:483–488.

Don’t Drink Your Milk!: Ear specialists frequently insert tubes into the ear drums of infants to treat recurrent ear infections. It has replaced the previously popular tonsillectomy to become the number one surgery in the country. Unfortunately, most of these specialists don’t realize that over 50% of these children will improve and have no further ear infections if they just stop drinking their milk. This is a real tragedy. Not only is the $3,000 spent on the surgery wasted, but there are some recent articles supporting the likelihood that most children who have this procedure will have long-term hearing losses. http://www.mercola.com/article/milk/no_milk.htm

“The most common culprit [that causes ear infections] is cow’s milk, in its natural form or as found in infant formula. It causes swelling of the mucous membranes, which interferes with the drainage of secretions through the eustachian tube. Eventually infection results because of the accumulated secretion.” – Robert S. Mendelsohn, MD

What About Antibiotics?

Although more antibiotics are prescribed today for children’s ear infections—and for longer periods of time—in the US than anywhere in the world, several recent, independently financed studies have found that for the vast majority of ear infections, antibiotics are little more effective than no treatment at all. http://www.mercola.com/2001/jan/14/whistle_blower.htm

Experts say the routine use of antibiotics against pediatric ear infections produces little health benefit while contributing to the spread of drug-resistant bacteria, and recurrent ear infection. The article evaluated the results of seven different studies conducted over the past 30 years. They found that while antibiotics were linked to short-term decreases in the duration of pain or fever in patients in a few (but not all) of the studies, no long-term (more than six weeks) benefits are reported. All seven studies concluded that children recovered from ear infections at roughly similar rates, regardless of type of treatment. JAMA November 26,1997;278(20):1643–1645

When Is Tympanostomy (Tubes in the Ears) Justified?

“In all my years of practice I have never seen a case in which a punctured ear drum did not heal itself. The principle justification for the procedure [tympanostomy] is to prevent hearing loss, which is no justification at all. Controlled studies have shown that when both ears are infected, and a tube is inserted in only one of them, the outcome for both ears is almost identical. Meanwhile the procedure itself carries many risks and side effects. Justified as means of preventing hearing loss, tympanostomy can cause scarring and hardening of the eardrum, resulting in hearing loss.” – Robert S. Mendelsohn, MD

Prevnar, Pneumococcal (Strep) Vaccine Does NOT Prevent Ear Infections and Has Major Side Effects

Abstracted from lecture by Erdem Cantekin, PhD, Professor of Otolaryngology at the University of Pittsburgh at the Second International Vaccine Information Center Conference September 9, 2000; Washington DC.

Prevnar is a new vaccine against pneumococcus. This is the most expensive routine vaccine to date. The wholesale cost is about $58.There are over 90 different strains of pneumococcus. The vaccine only has 7 strains assumed to be the common ones, but this is an uniformed experiment at best as there is no way to know if this will be covering all of the strains.

The FDA approval states the drugs is ONLY approved for invasive cases of pneumococcal disease such as bacteremia and meningitis. It is NOT approved for ear infections. This is most peculiar as it is commonly recognized that bacterial meningitis is primarily seen in adults not in infants for which this vaccine is recommended. The HMO trial in which Prevnar was approved had no placebo group. The control group received another experimental vaccine for mennigococcus. This was the ONLY trial that was done to establish the safety and efficacy to recommend this vaccine for every newborn in the US.

Just how well did the vaccine work in the HMO trial? In the first 17 cases of bacteremia it worked perfectly. However it was NOT effective for any cases of ear infections. If Prevnar could have stopped this or even reduced this problem it would have been great. But that is not the case. The FDA data from the HMO trial and that in Finland showed that the prevention benefit is less than 4%. The efficacy claims of Prevnar in ear infections and pneumonia remain unproven.

What About Adverse Side Effects of Prevnar?

The children who received Prevnar in the trial were:

• 4 times more likely to have seizures

• 4 times more likely to have stomach problems

Also, significantly more children who had been given Prevnar developed asthma. There was also one death in the Prevnar group and none in the other. Prevnar also alters the developing immune system. Additionally it will put selective pressure on the pneumococcal strains and has the potential to change the natural pattern of strep infections.

Over one trillion dollars of health care system are under the watchful eyes of the FDA, CDC, and the NIH. These three pillars of our public health care system have become to be more and more controlled by “expert panels” advisory committees. Such experts dictate policy and control the complex biomedical system. They directly influenced taxpayers health and wealth. However there is a huge conflict of interest as most of these experts served the special interest groups who profit in their decision. Many are in financial relationships with various manufacturers and are registered as their paid speakers or as some people might say paid lobbyists.

In Summary…

Ear infections will not cause permanent hearing deficits, and mastoiditis is so rare a condition that most contemporary physicians have never seen a case. Conventional treatment with antibiotics, other drugs and the surgical procedure known as tympanostomy is no more effective than the body’s own defenses in dealing with the problem.

Dr. Robert S. Mendelsohn’s Recommendations for Earache

1. Wait 48 hours before you call your physician.

2. Relieve the pain with a heating pad, two drop of heated olive oil (not hot) inserted in the ear canal, and the appropriate dose of acetaminophen if the pain becomes unbearable.

3. If the pain persists after 48 hours, see a doctor—not to treat infection, if that’s what it proves to be, but to rule out the possibility of trauma or the presence of a foreign body.

4. Don’t allow your doctor to use an instrument to remove wax from your child’s ear, and don’t try to do it yourself.

5. If your doctor examines your child and finds a viral or bacterial infection, question the need for antibiotic use. If he finds a foreign body, let him remove it, but again question the need for antibiotic use. If your child has a self-inflicted injury to the eardrum, your pediatrician may refer you to an ear and throat specialist. Be suspicious and question the need if he recommends surgical treatment or antibiotics. In all my years of experience I have never seen a case in which either was necessary.

6. If your child has chronic, recurrent middle ear infection, it is probably because of allergies or the antibiotics he was previously given. If your doctor recommends tympanostomy, don’t permit it without obtaining a second opinion. This procedure has replaced tonsillectomy as the favorite of pediatricians, but there is no reliable scientific evidence that it will do any good, and there’s considerable evidence that it may cause further harm.

Article originally posted at ICPA.org.