excerpt from The Left, the Right, and the State by Llewellyn H. Rockwell Jr. :

The logic of the market is predicated on the pervasive and glorious inequality of man. No two people have the same scales of values, talents, or ambitions. It is this radical inequality, and the freedom to choose our own lot in life, that makes possible the division of labor and exchange. Through money and contracts, markets allow us to settle differences to our mutual advantage. The result—and here is why people call the market miraculous—is a vast, productive system of international cooperation that meets an incomprehensibly huge range of human needs, and finds a special role for everyone to participate in building prosperity.

Now, to politics. The system of voting is designed to replicate the market’s participatory features. In fact, it is a perverse distortion of the market system. In markets, you get the goods you pay for. If you don’t and there’s been a violation of contract, you have legal recourse. In voting, people are not actually purchasing anything but the politician’s word, which is not only legally worthless; he has every incentive to lie to produce the desired result.

Politics take no account of individuals. You and I are merely tiny specks on the vast blob called “the American people,” and what this blob “thinks” is only relevant insofar as it accords with a political agenda advantageous to the state and its friends.

You think you are voting for tax cuts. Instead you get secret tax increases and perpetual increases in spending. You think you are voting for smaller government. Instead you get ever more government intrusion. This is because it is not the voters who are managing the system. It is well-organized interest groups who feed at the trough managed and owned by the state. Thus there is a vast gulf that separates the average voter from the politician’s real day-to-day interests.

The spectacle of elections grows more absurd every year. We are asked to cast ballots for people we do not know because they make promises they are under no obligation to keep. What’s even worse, the voting gesture is pointless on the margin. The chances that any one vote (meaning your vote) will actually have an impact are so infinitesimally small as to be meaningless.

In markets, entrepreneurial talent means the ability to anticipate and serve the needs of the buying public. In politics, success means the ability to manipulate public opinion so that enough fools (so regarded by politicians) reaffirm the politician’s power and glory. It takes special talents to do this—talents not cultivated in good families.

If American politics were characterized solely by voting and the products of voting, the system would be loathsome enough. And yet the corruption runs deeper. The real power behind Leviathan is wielded by a vast, unelected army of bureaucrats who fancy themselves specialists in the pseudoscience of public policy. In their minds, the only role for the citizenry, treated as a homogenous blob, is to conform or suffer the consequences. Gone are the cooperation, peace, and genuine diversity of markets. Instead, we experience brute force.

Intellectuals specialize in dreaming up grandiose tasks for government that would be doomed to fail even if perfectly implemented. And yet the most obvious criticism of all government schemes is that they must all be mediated by this corrupt system called politics.

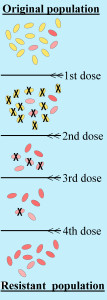

How different is this system from the one envisioned by people like Patrick Henry and George Mason? They hoped to erect a wall of separation between society and government to protect the people from being manipulated by cunning political forces. Indeed, the best of the American revolutionaries hoped for a society free of politics, a society free of any visible signs of government. Albert Jay Nock was right to characterize the state, democratic or not, as a parasite on society. Like a plague bacillus, its only successes are from its own point of view.