Yesterday we discussed an odd dynamic – US Treasury rates went up after the Federal Reserve (the Fed) cut its target interest rate by 50 basis points two weeks ago.

That being the case… what happens next? Is the Fed going to slash rates aggressively from here?

When we left off yesterday, I mentioned that Fed Chair Jerome Powell said two things in his talk that I found telling. First, he emphasized that he remains focused on “normalization”.

When a Wall Street Journal reporter asked Powell if rate cuts were a signal that the Fed would also start buying Treasury bonds again, the answer was a clear ‘no’.

Powell told him that this isn’t even a point of discussion right now. He added that “you can have the balance sheet shrinking but also be cutting rates”.

Here’s why that’s important…

The Fed purchased over $8 trillion dollars’ worth of Treasury bonds from 2008 to 2022. They created money from nothing to buy those bonds… which pumped liquidity into the financial system and helped drive interest rates down to zero.

When they were Fed Chair, both Ben Bernanke and Janet Yellen made it a habit to buy more Treasury bonds whenever the Fed’s existing bonds matured. That kept the cheap money game going for longer than otherwise would have been possible.

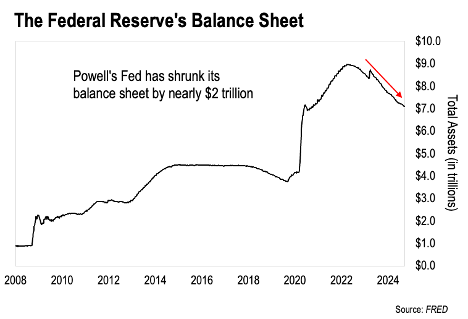

Powell broke ranks and reversed course with his quantitative tightening (QT). This chart tells the story:

As we can see, Powell has allowed nearly $2 trillion worth of Treasury bonds to mature without buying more. This effectively drains liquidity from the financial system. That, in turn, puts upward pressure on interest rates.

The big takeaway here is that maintaining QT will partially offset direct cuts to the federal funds rate… especially with regards to longer-term interest rates. We already see that happening with the bear steepener formation in place as we discussed yesterday.

And Powell more or less confirmed this dynamic in his talk. He stated explicitly that the Fed is not going to cut rates nearly as deeply during this cycle. He said he thinks the ‘neutral rate’ is considerably higher than where it was from 2008 to 2021.

When Powell talks about the neutral rate, he’s referring to the rate which the Fed sees as neither stimulative nor restrictive to economic growth. This is more Keynesian folly. But it’s to be expected. The Fed is fundamentally a Keynesian institution.

Keynesian theory still dominates Academia and American politics… though that is changing rapidly. The seeds of an Austrian awakening have already been sowed. But that’s a story for another day.

The key here is that Powell told us directly that rates aren’t going back to where they were. As I’ve harped on before – the Age of Paper Wealth is over.

And then something interesting happened right in my back yard that seems to confirm this. More on that tomorrow…

-Joe Withrow

2 thoughts on “Breaking ranks…”

Comments are closed.