“Your dollar is a promise, a pact of trust,” President Nixon once assured the nation. “It will hold its value, come what may.”

The date was August 15, 1971. The day the world’s financial landscape was forever altered.

Nixon had just closed the “gold window”, a system that allowed foreign countries to exchange their US dollars for physical gold. This had been a cornerstone of the global monetary system for nearly 30 years.

The essence of this system was trust. But not in the US dollar. In gold.

If the United States started to print money excessively, the rest of the world could exchange their dollars for gold. That’s what the gold window was for.

The narrative behind Nixon’s “gold shock” is complex, but the aftermath is starkly clear…

Since Nixon’s decision, the US has created over $8 trillion out of thin air. This naturally diluted the purchasing power of each circulating dollar.

This is evident in the rising consumer prices we are all grappling with today.

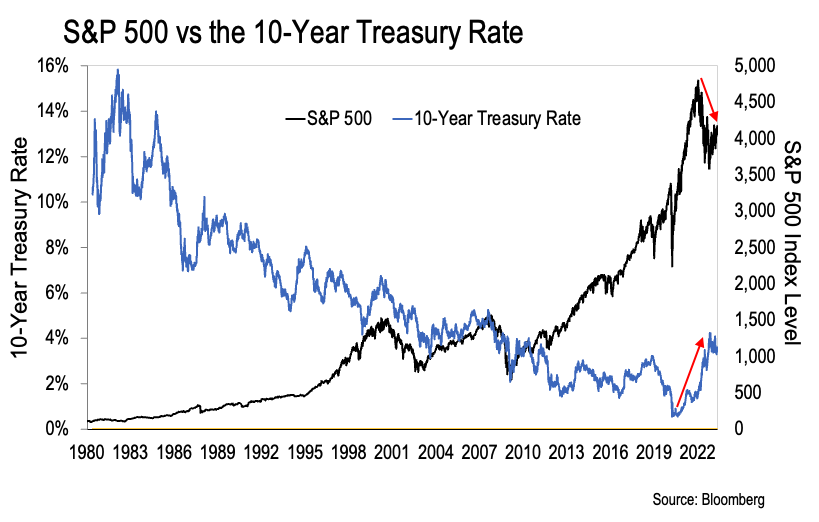

But there’s another, less visible story unfolding. This chart reveals the truth:

Continue reading “What to do when trust is broken…”