by Ron Paul – Ron Paul Institute for Peace and Prosperity:

One of the great ironies of American politics is that most politicians who talk about helping the middle class support policies that, by expanding the welfare-warfare state, are harmful to middle-class Americans. Eliminating the welfare-warfare state would benefit middle-class Americans by freeing them from exorbitant federal taxes, including the Federal Reserve’s inflation tax.

Politicians serious about helping middle-class Americans should allow individuals to opt out of Social Security and Medicare by not having to pay payroll taxes if they agree to never accept federal retirement or health care benefits. Individuals are quite capable of meeting their own unique retirement and health care needs if the government stops forcing them into one-size-fits-all plans.

Middle-class families with college-age children would benefit if government got out of the student loan business. Government involvement in higher education is the main reason tuition is skyrocketing and so many Americans are graduating with huge student loan debts. College graduates entering the job market would certainly benefit if Congress stopped imposing destructive regulations and taxes on the economy.

Politicians who support an interventionist foreign policy are obviously not concerned with the harm inflicted on the middle-class populations of countries targeted for regime change. These politicians also disregard the harm US foreign policy inflicts on Americans. Middle- and working-class Americans, and their families, who join the military certainly suffer when they are maimed or killed fighting in unjust and unconstitutional wars. Our interventionist foreign policy also contributes to the high tax burden imposed on middle-class Americans.

Middle-class Americans also suffer from intrusions on their liberty and privacy, such as not being able to board an airplane unless they submit to invasive and humiliating searches. Even children and the physically disabled are not safe from the Transposition Security Administration. These assaults are justified by the threat of terrorism, a direct result of our interventionist foreign policy that fosters hatred and resentment of Americans.

Some “military Keynesians” claim that middle-class workers benefit from jobs in the military-industrial complex. Military Keynesians seem to think that the resources spent on militarism would disappear if the Pentagon’s budget were cut. The truth is, if we reduced spending on militarism, those currently employed by the military-industrial complex would be able to find new jobs producing goods desired by consumers. Even those currently employed as lobbyists for the military-industrial complex may be able to find useful work.

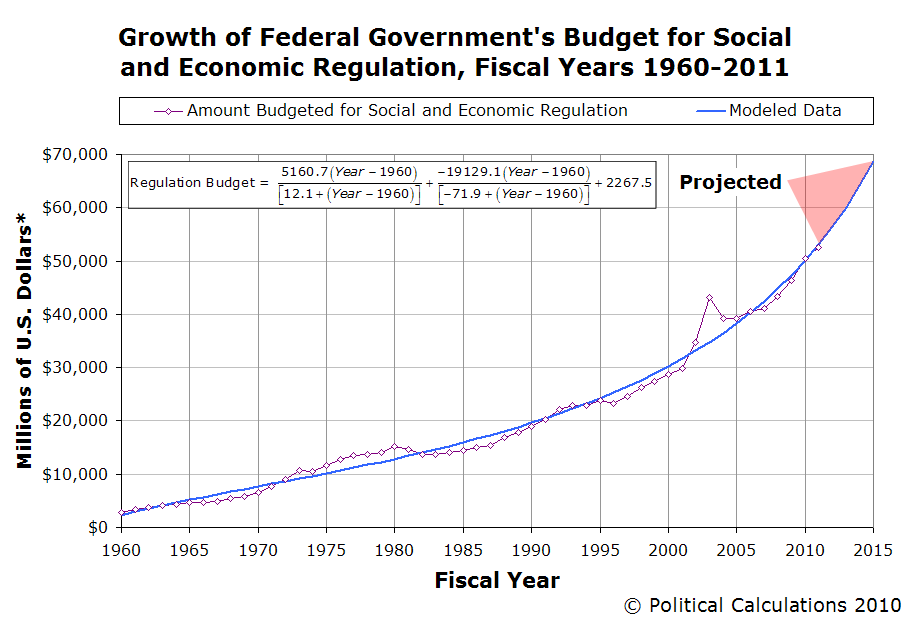

Few things would benefit the middle class more than ending the Federal Reserve. The Federal Reserve’s inflationary policies erode middle-class families’ standards of living while benefiting the financial and political elites. Middle-class Americans may gain some temporary benefits from Federal Reserve created booms, but they also suffer from the inevitable busts.

As I write this, the dollar still reigns as the world’s reserve currency. However, there are signs that other economies are moving away from using the dollar as the reserve currency, and this trend will accelerate as the Federal Reserve continues to pump more fiat currency into the economy and as resentment toward our foreign policy grows. Eventually, international investors will lose confidence in the US economy, the dollar will lose its reserve currency status, and the dollar bubble will burst.

These events will cause a major economic downturn that may even be worse than the Great Depression. The main victims of this crisis will be average Americans. The only way to avoid this calamity is for the American people to force Congress to free them from the burdens of the warfare state, the welfare state, taxation, and fiat currency.

Article originally posted at The Ron Paul Institute for Peace and Prosperity.