Americans of all ages, all conditions, and all dispositions constantly form associations… The Americans make associations to give entertainment, to found seminaries, to build inns, to construct churches, to diffuse books… Wherever at the end of some new undertaking you see the government in France, or a man of rank in England, in the United States you will be sure to find an association.

I love this quote by Alexis de Tocqueville. It speaks to the principles of private association and mutuality that were so prevalent in 19th century America.

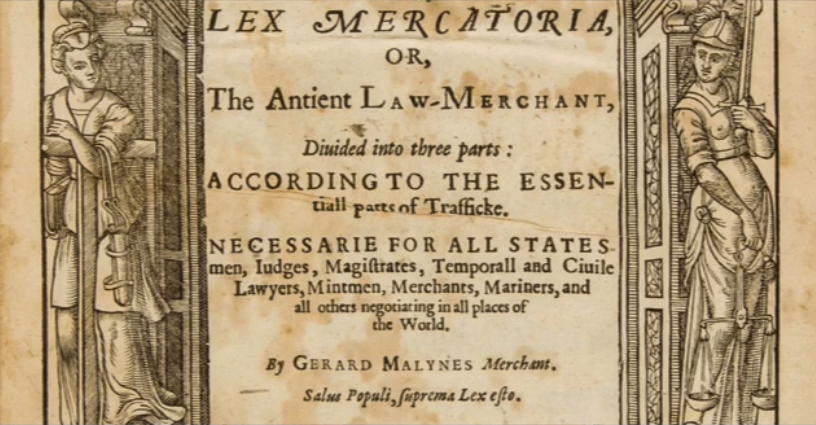

We’ve been talking all week about the historical influences that underpin our new investment membership The Phoenician League. And today we’ll wrap up our discussion by assessing the mindset that was core to the American experiment.

19th century America featured a robust network of mutual aid societies. This is a topic that I’ve only learned about through independent study. My public school textbooks failed to mention anything about it.

What’s forgotten is that mutual aid societies were the backbone of American society before the Welfare State. They provided safety nets just as the Welfare State does today… but these networks were so much more than that.

Continue reading “The American story they don’t teach in school”