For the last two generations, the success plan was clear.

Go to school —> get good grades —> go to college —> get a good job. If you followed that plan and had a good work ethic, a successful middle-class lifestyle would come easy to you.

And for those more ambitious, there were very few roadblocks to starting a business. Opportunity was everywhere.

That was the American dream. It’s what inspired countless immigrants to leave their homeland to create a new life in this country.

But that dream is fading.

The traditional success plan – go to school, get good grades, get a job – it no longer guarantees success. Colleges today load students up with debt and fill their heads with all kinds of useless claptrap.

Meanwhile, the Administrative State peppers small businesses with all kinds of regulatory burdens. Those small business success stories from a generation ago would be hard-pressed to recreate the same success if they had to start today.

And to top it off, reckless government spending has driven up everybody’s cost of living dramatically in recent decades. They finance this spending with printed money, and that creates consumer price inflation. It’s wiping out the middle class.

And that’s not just an opinion. It’s all in the data. Today I’ve got two tables for you that spell it all out, clear as day.

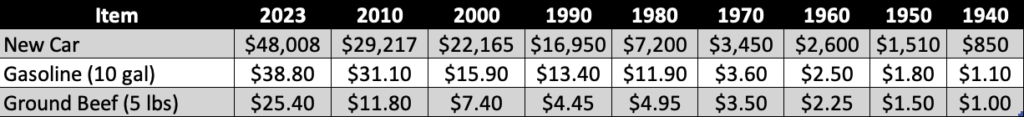

Here’s the first:

This table tracks the median price of a new car, ten gallons of gas to put in that car, and five pounds of ground beef going back to 1940.

As we can see, it’s not a pretty picture. Costs have risen dramatically over every ten year period in modern history.

That said, we have to compare these costs to the median income to get a better feel for the story. And that’s what this next table does:

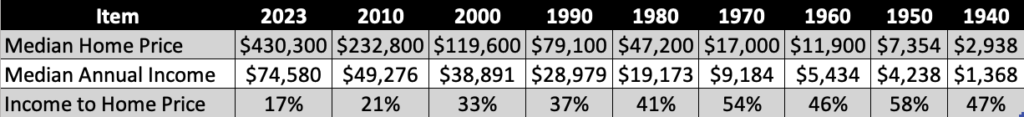

Here we’re tracking the median home price compared to median annual incomes going back to 1940.

And again, we can see that home prices have risen significantly over every ten year period. But incomes have too… so it’s that third line we need to focus on. It shows us exactly what percentage of the median home the average guy’s salary can cover.

The median home costs $430,300 today. The median annual income is $74,580. That means the average person’s salary can only cover 17% of the median home price.

We can see just how dramatic this is by looking at past data.

If we go back to the turn of the century, the median income could cover 33% of the median home price. That’s nearly twice as much.

Then if we go back to 1970—the median salary could cover more than half of the median home price. If that were the case today, the average person would be making $232,362 a year.

What these numbers illustrate is that it has become harder and harder to live a comfortable middle class life in the US. And it’s all because inflation has eroded the value of our dollar… thus, costs have risen far faster than incomes.

We can’t do much to change this dynamic. But we can protect ourselves from it with strategic investments.

Consumer Goods Inflation Hedges

Inflation has eroded the average American family’s disposable income.

We see this in the charts above. And we see it if we look at the data for average savings rate and credit card debt. Savings has plummeted while credit card debt has ballooned.

This doesn’t bode well for companies selling higher-end goods. Luxury cruises… high-end cars… overpriced fashion brands – these businesses and many like them are going to struggle in the years to come.

At the same time, there are certain goods the American consumer will always buy – regardless of how tight the monthly budget is.

For example, people will still go to the supermarket regularly. They’ll buy their food, soda, snacks, candy, personal care products, and household cleaners… just like they always have.

Many families will still go out to eat regularly as well. The convenience is hard to beat.

Except instead of going to a nice restaurant, many will choose fast food because it’s cheaper. There’s a reason why certain fast food chains are among the world’s best businesses.

Given Americans’ addiction to coffee and sweet drinks, Starbucks and other coffee shops are likely to remain popular in the years to come as well – even as the middle class continues to shrink.

And what about discount stores like Walmart and Dollar General?

They will continue to offer consumers every-day goods at low prices. These “lower end” stores will likely gain new customers as inflation wreaks havoc on disposable income.

The point is, the American consumer isn’t going away. But his spending habits are likely to shift to lower-price alternatives.

So, there are at least a handful of publicly-traded companies that will benefit from this shift in consumer spending. Their stocks are our consumer goods inflation hedges.

And here’s the thing – some of these companies are fantastic businesses. They are capital-efficient and shareholder friendly. That’s exactly what we’re looking for in a great investment.

The key is – as with our other market-based investment “buckets” – we must buy these companies when they trade at a reasonable valuation.

If we’re patient enough, we’ll be able to add these inflation hedges to our portfolio at an incredible price. Then we can reinvest the dividends to compound our investment for years to come.

-Joe Withrow

P.S. We talk about asset allocation and specific investment suggestions inside our investment membership The Phoenician League.

Our goal is to help all our members bulletproof their money, just as we’ve been discussing. From there we create a cash flow wealth strategy. It’s all about building additional income streams to make our financial situation far more robust.

If you’d like more information on our program, just go here.