For generations, succeeding in America was simple…

Go to school—> get good grades—> go to college—> get a good job.

If you followed this plan and worked hard, a middle-class lifestyle was easy to achieve.

And those more ambitious could start a business with almost no regulatory obstacles. Opportunity was everywhere.

Not anymore…

Because the American Dream that inspired millions of immigrants to leave their homeland and create a new life in the US… is fading into history.

Today, many colleges load up students with debt and fill their heads with destructive ideas—the kind of ideas that prevent success in the real world.

Meanwhile, the bureaucracy in Washington churns out endless regulations – strangling small business success. Many entrepreneurs from a generation ago would be hard-pressed to recreate their same success today.

And to top it off, reckless government spending and money printing are driving up the cost of living for everyone.

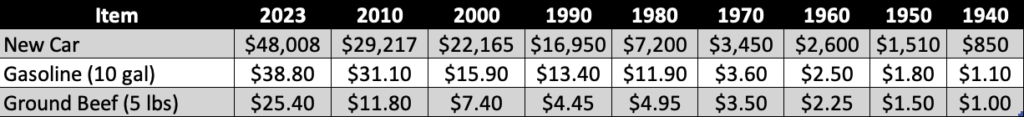

Just look at this data on consumer price inflation:

This table looks at the median price of a new car, ten gallons of gas, and five pounds of ground beef going back to 1940.

Beef is up 2,400%… Gas is up 3,400%… and a new car is 5,500% more expensive. No wonder so many people are struggling! And look at the effects of inflation on the most basic necessity of all – putting a roof over your head

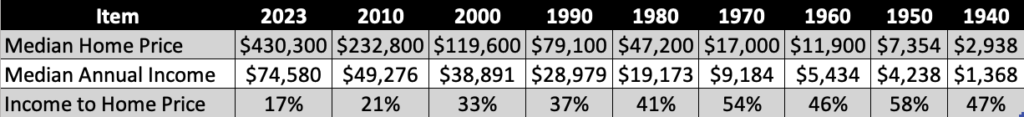

That’s a chart of the median home price compared to median annual incomes going back to 1940.

The third line shows what percentage of the median home is covered by the average person’s salary.

The median home today costs $430,300 – while the median annual income is only $74,580. Today, the average person’s salary can only cover 17% of the median home price.

Back in the 1940s, 50s and 60’s, you could buy a house with only a few years of savings. Today, that dream is almost out of reach.

As recently as the 1970s the median salary could cover more than half of the median home price.

If that were the case today, the average person would be making $232,362 a year.

The numbers don’t lie.

Thanks to inflation, costs are rising much faster than incomes. And the middle class is now on the endangered species list.

After all, the super-rich don’t stop to count the cost of necessities like the middle class. So inflation just isn’t much of an issue to the wealthy elites who drive these destructive policies.

Here’s the thing…

You and I cannot change this dynamic. The politicians will always look for the easiest way to get more money – which is to print it out of thin air.

The good news is…

You CAN protect yourself from inflation if you understand the new rules of money in the 2020s.

Go here to find out about my new Finance for Freedom Mastermind.

This is the fastest way to master your finances by learning the new rules of money for the 2020s and beyond – starting in just 30 days or less.

Imagine how you’ll feel when you no longer have to watch helplessly while your hard-earned money is destroyed by inflation…

Imagine the confidence you’ll have when you know how to make smart financial decisions that safeguard your earnings and ensure a secure future for you and your loved ones…

If you’re intimidated by money or think this topic is overwhelming… you can relax.

I specialize in explaining highly technical concepts quickly and simply.

You and I can even speak personally inside our community mastermind calls – where all your questions about financial freedom will be answered.

And you will get the benefit of hearing other people’s questions and experiences as well. In many counselors there is security, as the late Dr. Gary North used to say.

Are you ready to take control of your financial future? You better be…

Because the changes happening in our financial and monetary system will not wait longer for your decision.

-Joe Withrow